Only days ago, the people of Greece gave a resounding NO to IMF/EU austerity bailout programme. Yet, no less than the man who called for such referendum capitulated to all the terms previously presented by the Troika with additional preconditions.

It is as if the referendum did not happen at all, nor any of those previous negotiations ever took place. He just swallowed all the stuffs served upon his face, and even promised to institute discipline within his own party membership in the Greek parliament.

Yeah, that’s how you lick some EU asses and lick them good.

Alexis Tsipras simply doesn’t have what it takes to lead the Greeks out of their misery.

What is more appalling is the fact that it is now the Troika lenders that are asking the Greeks to rebuild trust from hereon. Here you can find the robbery victims themselves that are needing to prove their full commitment to the same banditry that’s causing their whole economy to go up in smoke for the last seven years.

Remember, 90% of the bailout funds were not actually put into the Greek economy but directly into the German and French banks only. So, how could they ever get out from this EuroMess using the same rotten formula?

These economic hitmen really has no equal. They need to be horizontalized immediately. But then again…

Sold! German Bank to Control, Sell Greek Public Assets

Sputnik

20:59 13.07.2015(updated 21:29 13.07.2015)

One of the harsh conditions that Greece had to accept this weekend to receive its next bailout package from a group of international creditors to save its crumbling economy was to agree to hand over €50 billion worth of its public assets to an external fund.

Greece and its international creditors reached an agreement after long negotiations over the past weekend. The cash-strapped Mediterranean nation will now receive a €95-billion bailout over the next three years in exchange for quite harsh economic reforms.

However, the deal didn’t come as easily for Greece. German Finance Minister Wolfgang Schaeuble proposed that as much as €50-billion of Greek public assets must be transferred to an external fund and privatized over time.

Essentially, this means Greece must hand over its public assets worth €50-billion — to the German-government owned fund to be sold by the Germans.

The fund is called the Institution for Growth and controlled by the German bank KfW, a German government-owned development bank based out of Frankfurt. Now this is where things get awkward: the current Chairman of the Institution for Growth is none other than Schaeuble himself.

The move may be interpreted as impinging on the sovereignty of Greece. However, what can the Mediterranean nation really do? The morale of the story is simple: bend to Germany’s will, or your economy will be destroyed.

Sputnik

Greece Capitulates to Creditors’ Demands to Cling to Euro

by Karl Stagno NavarraIan WishartRebecca Christie

Prime Minister Alexis Tsipras surrendered to European demands for immediate action to qualify for up to 86 billion euros ($95 billion) of aid Greece needs to stay in the euro.

After a six-month offensive against German-inspired austerity succeeded only in deepening his country’s economic mess and antagonizing his European counterparts, there was no face-saving compromise on offer for Tsipras at a rancorous summit that ran for more than 17 hours.

“Trust has to be rebuilt, the Greek authorities have to take on responsibility for what they agreed to,” German Chancellor Angela Merkel said after the meeting ended just before 9 a.m. in Brussels Monday. “It now hinges on step-by-step implementation of what we agreed.”

The agreement shifts the spotlight to the parliament in Athens, where lawmakers from Tsipras’s Syriza party mutinied when he sought their endorsement two days ago for spending cuts, pensions savings and tax increases. They have until Wednesday to pass into law key creditor demands, including streamling value-added taxes, broadening the tax base to increase revenue and curbing pension costs.

Disaster Averted

While the summit agreement averted a worst-case outcome for Greece, it only established the basis for negotiations on an aid package, which would also include 25 billion euros to recapitalize its weakened financial system.

The Stoxx Europe 600 Index climbed 1.5 percent at 9:55 a.m. in London, while futures on the Standard & Poor’s 500 Index erased a drop to rise 0.3 percent.

With Greece running out of money and its banks shut the past two weeks, the summit was billed as its last chance to stay in the euro. Greece has been in financial limbo since the government missed a payment to the International Monetary Fund and allowed its second rescue package to lapse on June 30.

Did Greece Have a Better Deal Before the Referendum?

“The Greek government has accepted practically everything,” Maltese Prime Minister Joseph Muscat said in an interview. “It accepted all the crucial and important points.”

The conditions that Tsipras swallowed comprised a laundry list of unfinished business from Greece’s two previous bailouts and a new demand for the government to transfer 50 billion euros of state assets to a holding company that will seek to either sell or generate cash from them. His creditors rejected Tsipras’s pleas for a cut in the face value of Greek debt of about 310 billion euros.

Debt Discussions

Merkel said interest-payment grace periods and longer maturities will “be discussed once there is a successful evaluation of the new Greek program.”

As the summit approached its climax in the early hours of Monday, the main session broke at least four times to allow Tsipras to confer with associates in Athens, according to one official with knowledge of the talks. Tsipras told the creditors he’d enforce party discipline in parliament, the official said. The terms are significantly tougher than those he labelled “blackmail” when he persuaded Greek voters to reject them in a referendum a week ago.

Calling that vote “has turned into one of the most expensive economic policy mistakes in the European Union for a long time,” Holger Schmieding, chief economist at Berenberg Bank in London, said in a note to clients Monday. “The much bigger sums which creditors now need to offer and the tougher conditions Greece now has to meet make it harder for both sides to deliver on the bargain.”

Return to Athens

In addition to requirements on pensions and sales taxes, measures that Tsipras accepted last week, the leaders demanded that creditor representatives return to Athens with full access to ministers and a veto over relevant legislation, intrusions that he has long rejected.

Greece Situation Still Fragile: Roivas

“We had to succeed,” said French President Francois Hollande. “If Greece had left the euro zone what would the world have said? That the euro zone wasn’t able to maintain its integrity? That Greece couldn’t assume its responsibilities? That France and Germany couldn’t propel this project forward?”

The cost of insuring corporate debt declined, pushing the Markit iTraxx Europe Index to a five-week low. The gauge of credit-default swaps covering investment-grade companies fell two basis points to 66 basis points. The Markit iTraxx Europe Senior Financial Index slid four basis points to 75 basis points.

Saving Banks

Tsipras said that the deal had prevented the banking system collapsing but will inevitably harm the economy. He’ll return to Greece to face a political backlash that may force him to organize a government of national unity or call new elections after retreating from his campaign promises to lift wages and throw off the yoke of austerity.

“We put up a hard fight for the past six months and we fought to the end in order to get the best out of it, to get a deal which will allow the country to stand on its feet and the Greek people to keep fighting,” Tsipras said in Brussels.

Nikos Filis, the parliamentary spokesman for Tsipras’s governing party, said that Greece had been “waterboarded” by euro-area leaders during the negotiations and accused Germany of “tearing Europe apart” for the third time in the past century. “#ThisIsACoup” became the most-trending Twitter hashtag in both Greece and Germany overnight.

Greece’s banks remain shut and capital controls will remain in place when they reopen, as soon as this week if there’s a deal, Economy Minister George Stathakis told Mega TV.

The banks are expected to stay closed on Monday, so the ECB won’t need to adjust its now-frozen emergency credit line to the banks right away, an EU official said as leaders were meeting. The ECB’s Governing Council is slated to review the banks’ situation again on Monday when the Greek government is set to renew a bank holiday and capital controls decree expiring today.

Bloomberg

Tsipras Has Vandalized Greece

What has Alexis Tsipras achieved for the Greek people?

Monday morning, after 14 hours of talks among the euro area’s finance ministers and an additional 17 hours among the group’s leaders, the Greek prime minister came away with a much worse deal than the one he just persuaded Greek voters to reject. Now he must sell it to his parliament and people.

To be clear, for all the previous overheated talk of Greece’s “humiliation” by the euro area countries that were bailing it out, this deal is indeed humiliating for Tsipras and Greece. The decision to set up a fund into which the country has to place 50 billion euros ($55 billion) worth of assets for privatization is the kind of thing that courts do to bankrupt companies ruled no longer competent to manage their own recovery.

QuickTake Greece’s Fiscal Odyssey

The demand that Greece’s parliament must, within three days, legislate for measures the government has in the past described as “criminal” and “terrorist” only underscores the degree to which Greece’s economic sovereignty has been suspended.

No matter what the parliament decides and whether Greece ultimately stays in the euro or leaves, Europe will pay a price down the road for such a vengeful act. Many Greeks are enraged, and the prominent role played by Germany in driving such a harsh bargain has awakened old stereotypes, which the European Union and its common currency were designed to dispel forever.

Right now, however, it is Tsipras whom Greeks should blame. Consider where the country was a little more than a year ago, when his political party Syriza burst onto the scene by winning Greek elections to the European Parliament. The party argued that, were it not for the supine approach that the country’s then center-right government was taking toward its creditors, Greece could end austerity measures, return to prosperity and keep the euro. That was not true, but it was attractive.

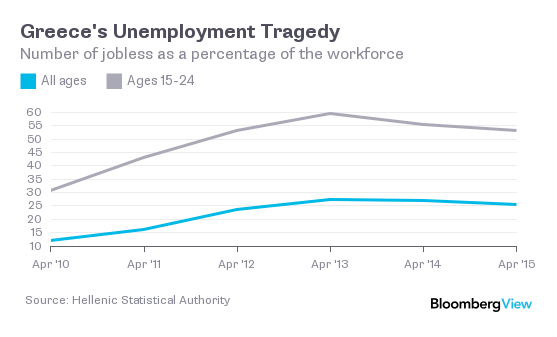

Times were still very tough for Greece in 2014. In April of that year, however, the country returned to international bond markets for the first time in four years, selling 3 billion euros worth of five-year securities at an interest rate of 4.95 percent. Unemployment, having hit a high of 27.5 percent in 2013, was falling. By April 2015, the latest available figure, the jobless rate was 25.6 percent.

Economic growth had also returned to positive territory, hitting 1.7 percent in the fourth quarter, a rate substantially higher than the 0.9 percent euro area average, according to Eurostat.

I’m not arguing here that all would have been rosy, were it not for Tsipras and Syriza. The euro area needed then, and still needs, to come to terms with writing off Greek debt. Yet it’s hard to call what has happened in Greece over the past year anything but a self-inflicted act of economic vandalism.

By the second half of 2014, Tsipras’s political promises were popular enough to prompt former Prime Minister Antonis Samaras to hold back on fulfilling some of the required bailout terms. He forced early elections in an attempt to regain support for sticking with the bailout, arguing correctly but unsuccessfully that the alternative would be for Greece to exit the euro.

Greece then lost its ability to borrow in the market again. Over the past six months, the four-year benchmark bond has traded at an average yield of just under 16 percent. And while the data aren’t yet available to track Greece’s unemployment and output over the past few months, they have certainly turned negative — especially since the imposition of capital controls forced the economy into a hard stop.

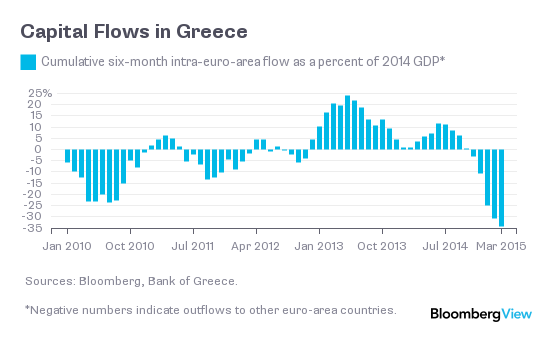

Last year, Greece’s banks were solvent. Throughout 2013, confidence about the country’s place in the euro grew, and people were bringing money back to deposit. As Syriza rose and the political situation became less certain, however, confidence in Greece’s economic future began to wane. This year, those flows have turned sharply negative, gutting the financial system from within and forcing it onto life support at the European Central Bank.

As a result, even a less punitive bailout deal would have put Greece in a worse position, because the cost of digging out of its financial hole has risen significantly.

Syriza’s false promises have brought the erstwhile fringe party once-unimaginable political success. Yet after gaining power, the party eviscerated an already weak economy, bankrupted the financial system and caused untold needless hardship to the very people Syriza claimed to speak for: the poor.

Tsipras gambled with his country’s fortunes, betting that the rest of the euro area would be so fearful of creating a precedent for an exit that they would capitulate to his demands and write him a blank check. The strategy reached its apogee with his absurd July 5 referendum, in which he asked Greeks to vote against the latest bailout proposal, while again promising that this would not put Greece’s euro membership at risk. He has now capitulated, apparently aware that he has no mandate to leave the euro. And so his lie is exposed, together with its cost to the Greek people.

Greeks have ample reason to be mad at their euro area partners, but they should hold their own prime minister responsible for destroying their economy in a reckless political experiment. Regrettably, this is not over. As a result of the prime minister’s actions and Europe’s brutal response, Tsipras — or a successor Greek government — may yet get a mandate to abandon the euro.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

To contact the author on this story:

Marc Champion at

mc********@bl*******.net

“>

mc********@bl*******.net

To contact the editor on this story:

Mary Duenwald at

md*******@bl*******.net

“>

md*******@bl*******.net

Bloomberg

After “Deal”, Here’s What’s Next For Greece

Submitted by Tyler Durden on 07/13/2015 06:54 -0400

Now that Greece has capitulated and offered up its sovereignty in what can only be described as an unconditional surrender to Berlin and Brussels, you might be curious as to what the most likely next steps are for Greece, its government, and its people.

For reference, here is a quick summary courtesy of Bloomberg:

WHAT’S NEXT?

- The Greek govt is set to renew a bank holiday and capital controls decree which expires today

- The ECB’s GC is expected to discuss ELA for Greece’s banks

- Eurogroup meeting later today will work on Greece’s short-term needs and discuss bridge financing

- Greece has accepted to legislate on 4 action points by Thursday July 16, and another two by July 22, according to Malta’s PM Muscat

- Then Greece would come before the Eurogroup and euro- area member states would decide to open or close the needed negotiations that would let the ESM to disburse funds, Muscat says

- Dutch PM Rutte says it could take weeks to negotiate Greek ESM aid deal

WHAT DOES IT MEAN FOR GREECE’S BANKS?

- Greek banks are to be recapitalized by Greek asset fund and Tsipras says the deal protects the stability of the banking system

- ELA will stay in place all the while that another bailout is in the pipeline, Mizuho’s Peter Chatwell says in e-mailed comments

- ECB ELA will most likely stay in place until at least Wednesday, pending Greek ability to legislate the list of prior actions, Oxford Economics says in a note

WHAT ABOUT TSIPRAS AND SYRIZA?

- Support at Wednesday’s vote from Greece’s pro-Europe parties will come at a cost, when the timing is right, Barclays says

- It makes more sense for those parties to let PM Tsipras bear the political cost of capital controls while triggering elections would make default inevitable, plunging the country into a complete paralysis for the next 30 days

- Don’t entirely rule out a coalition partner change (with To Potami), and believe this situation will eventually lead to new elections after the summer

- A new unity govt or an early election very possible, Rabobank says

- Given political fractures in Greece, passage of the proposal through parliament is far from certain, Richard Cochinos, strategist at Citigroup, says in client note

- Decent likelihood of a Greek cabinet reshuffle; govt could possibly fold on reforms

- Tsipras may seek to expel those opposed to a deal with creditors from the party as he no longer commands a majority in parliament, Reuters said, citing people familiar

- “Constructive” centrist parties will likely continue to support the government coalition, Barclays says

- Snap elections necessary but can’t take place now, Greece’s Labor minister Skourletis says

WHAT ABOUT ITS CREDITORS?

- Germany, the Netherlands, Austria, Slovakia, Estonia and Finland all need parliamentary approval to open negotiations on a new Greek program, an EU official said last week, while France’s Hollande said French National Assembly to vote on the deal on Wednesday

- While Marcel Fratzscher, president of the DIW economic institute, says it will be very difficult to sell the deal to German voters and Germany’s Greens say the deal means Greece will be stuck in a recession, a govt lawmaker said it is likely the German coalition will approve the deal

- Rutte says he’s unhappy he has to break an electoral promise to Dutch constituents on no further Greece aid

- The deal is so tough there’s a better than even chance that the Finnish parliament will authorize the negotiations, Berenberg’s Holger Schmieding writes in e- mailed comment

- Even if a deal can eventually be reached to keep Greece in the euro area, there will be long-term consequences, the damage done to relations between France and Germany may prove irredeemable while Germany’s suggestion Greece be granted a short term exit from the single currency shatters the principle that euro-area membership is irrevocable, Oxford Economics says

IS THERE ANY AGREEMENT ON RESTRUCTURING GREECE’S DEBT?

- Over the weekend, an IMF source told Reuters said that if other creditors couldn’t agree on a haircut, grace periods on interest payments could be combined with lower rates and extended maturities

- Tsipras said the negotiations had managed to gain restructuring while Merkel confirmed interest-payment grace periods and longer maturities will “be discussed once there is a successful evaluation of the new Greek program”

WHAT ABOUT GREXIT?

- Tsipras says summit outcome averts collapse of banking system

- Risks of a Greek exit have reduced in the very short term as the ECB should remain supportive as long as prior actions are passed in Parliament by Wednesday and talks are headed in the right direction, Barclays says

- The chances of a Grexit have now fallen below 50%, UBS WM write

- The deal and Wednesday’s vote may stretch the Greek govt to breaking point, forcing new elections; the month’s hiatus that would ensue while elections took place would almost certainly see Greece ejected from the euro area, Oxford Economics says

This doesn’t sound good at all. Their own leader sold them out. I hope the Greeks take notice,… get mad as hell,… & still take their country back. Otherwise,… they are being sold in exchange for counterfeit paper,… The good old “sleight of hand” the banksters are notoriously famous for,…