We have been waiting for Keenan’s Final Lawsuit that will bring down the Cabal for good. But are we ready for the initial shock? That event when the big Fiat System Collapse actually happen?

The profound implications of which cannot be understated.

We had been urging everyone to get into disaster readiness for some time, and it is more so at this point in time. Although the cooperating/reformists banks were said to be ready and able to implement the new system, it is always to our advantage to prepare for something we haven’t been into before.

Or, are we already in so dire a situation, and what could be worse?

Thanks Drake.

–

Gold Buying Panic In China: 10,000 People Wait In Line For Their Chance to Own Precious Metals

Mac Slavo

June 14, 2013

One day in the near future Americans will finally realize that their money is being devalued at a rapid pace. For the time being the price increases are somewhat muted by official announcements of inflation being under control at around 2% and purported economic recovery on the horizon. The Federal Reserve and the US government are doing everything in their power to maintain a perception of stability.

But what happens when all the machinations are proven to be fruitless during the next stock market crash and currency crisis?

That’s when people panic. That’s when they start mass selling assets that hold no true value, and shift their capital to physical goods that store and preserve wealth.

In China, where the central government has manipulated the currency, economic and financial markets for decades, the people have seen it all before. And they aren’t taking any chances.

While the paper price of gold and silver may have dropped nearly 25% this year, it’s clear that demand in the real world is soaring.

If you want to know what it’s going to look like in front of precious metals dealers when confidence in our government’s ability to manage this crisis is finally lost for good, then look no further than the streets of China.

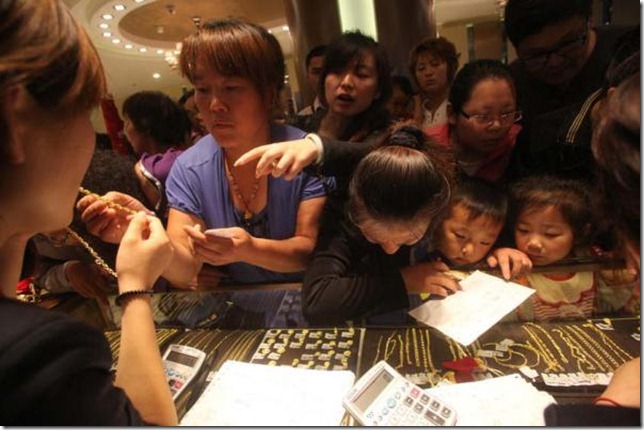

The following pictures, taken in Jinan in the last 48 hours, depict some 10,000 Chinese citizens lining up to buy physical gold, providing all the evidence you need for the argument that gold is, in fact, money.

These are absolutely stunning.

Images from Caixin via Zero Hedge

The pictures are reminiscent of Americans lining up around the block during the gold buying sprees of the 1980′s in an attempt to get their hands on physical gold and silver.

Just as is the case with food, guns, ammunition, Xboxes, and iPhones, when widespread demand strikes it’s nearly impossible to get your hands on the goods you need at a fair price.

Get yours now, before the panicked masses realize what has happened.

This article was posted: Friday, June 14, 2013 at 4:41 pm

Drake | June 15, 2013 at 1:41 pm | Categories: News | URL: http://wp.me/p2tRr3-X6

One of the significant sources of funds for the Cabal is the healthcare industry which registered a whopping $2.7 trillion in 2011, and is projected to soar to $3.6 trillion in 2016, in the US alone. We believe that this is just a conservative figure.

You can join the fight against the Dark Cabal and accelerate its demise just by boycotting Big Pharma. You can effectively do this by downloading “Towards Healthcare Emancipation“, a fully illustrated do-it-yourself instructional eBook that will help you in implementing all eClinik methods that would negate the use of expensive medicine, avoid radioactive diagnostics and treatments in completely defeating cancer, AIDS and all other parasitic diseases. These methods, when faithfully followed, work 100% all the time. Find out more about this here.

We are very grateful to the following for the love and support they’ve given us for the month of June 2013:

Pamela F, $100

Merna M, $20

James F, $10

Millard C, $15

Mabuhay!

June 14, 2013

Pamela F, $100

Merna M, $20

James F, $10

Millard C, $15

Drake…I really wish you would stop with the fear porn.

We have been ready for this for a very long time, I can assure you the rest of the world cannot survive much longer with the current financial situation and now is not the time to get cold feet.