Get ready for what may well be the geoeconomic bombshell of 2024: the coming of a decentralized monetary ecosystem.

Continue reading De-Dollarization Bombshell: The Coming of BRICS+ Decentralized Monetary EcosystemCategory Archives: Economy

Inflation Rising: The ‘Soft Landing’ Plane is Still Circling in America

For months the mainstream media and Washington Pols have been pushing the metaphor that the US economy is a plane on its final approach to a ‘soft landing’. Soft landing is defined as inflation steadily coming down to the Federal Reserve’s goal of a 2% price level AND does so without provoking a recession.

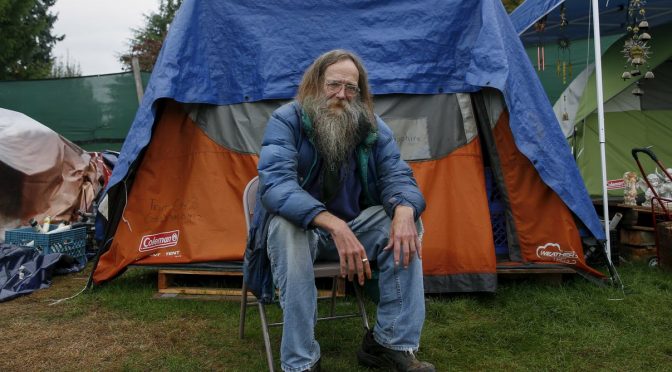

Continue reading Inflation Rising: The ‘Soft Landing’ Plane is Still Circling in AmericaUS Homelessness Reaches All-time High Amid Rising Cost of Living

A head count for the US Department of Housing and Urban Development (HUD) indicates that 653,104 persons were homeless this year, a more than 12% increase from last year.

Continue reading US Homelessness Reaches All-time High Amid Rising Cost of LivingA Multi-faceted Deception: The COVID-19 Power Grab as “Organized Crime”

Many holes are busting through the thick mental wall of media-generated obstructions meant to block wide public understanding of the COVID-19 power grab. The fake fight to vanquish the celebrity coronavirus is being widely exposed as a multi-faceted deception.

Continue reading A Multi-faceted Deception: The COVID-19 Power Grab as “Organized Crime”From Industrial Powerhouse to the Brink: The Shocking Factors Behind Germany’s Decline

Perhaps justifiable is the fact that Germany, which has significantly driven the EU’s eastward expansion and faithfully followed American neoconservatives in aggressively expanding NATO toward a retreating Russia, is currently facing its most severe economic crisis since World War II.

Continue reading From Industrial Powerhouse to the Brink: The Shocking Factors Behind Germany’s DeclineIs the debt ceiling the real issue for the US economy right now?

The drama around increasing the borrowing limit obscures the growing threat of a crash in the Treasuries market.

Continue reading Is the debt ceiling the real issue for the US economy right now?Even The Banksters are Being Forced to Admit that the U.S. Economy is Coming Apart at the Seams

It’s wake-up time. For months, there has been a tremendous amount of denial out there. So many of the “experts” assumed that the Federal Reserve and other central banks had everything under control and that things would “return to normal” before too long. But that hasn’t happened.

Continue reading Even The Banksters are Being Forced to Admit that the U.S. Economy is Coming Apart at the SeamsGlobal Planned Financial Tsunami Has Just Begun

Since the creation of the US Federal Reserve over a century ago, every major financial market collapse has been deliberately triggered for political motives by the central bank. The situation is no different today, as clearly the US Fed is acting with its interest rate weapon to crash what is the greatest speculative financial bubble in human history, a bubble it created.

Continue reading Global Planned Financial Tsunami Has Just Begun4 Signposts of American Collapse Which Also Occurred in the USSR

In thinking through the (for now) gradually unfolding collapse of the American empire, the collapse of the USSR, which occurred close through three decades ago, continues to perform as a goldmine of useful examples and analogies.

Continue reading 4 Signposts of American Collapse Which Also Occurred in the USSRThe US is in A Recession and It’s Worse Than You Think

The Fed’s solution to record inflation is based on flawed logic, and US government policy is only compounding supply issues.

Continue reading The US is in A Recession and It’s Worse Than You ThinkUS Plunges into Recession While US Oil Giants Reap Windfall Profits

The US economy has shrunk for two consecutive quarters, meeting one of the criteria for a recession, official figures released on Thursday suggest.

Continue reading US Plunges into Recession While US Oil Giants Reap Windfall ProfitsBeyond the Dollar Creditocracy: A Geopolitical Economy

Understanding of the dollar’s world role is dominated by the ideas of ‘dollar hegemony’ and ‘US hegemony’. In this paper, based on their extensive past work, Radhika Desai and Michael Hudson reveal how these ideas are ideologies, not theories.

They reveal an understanding that is theoretically sound and accords with the historical record, a geopolitical economy of the international monetary system of modern capitalism.

They begin with a theoretical outline of how money operates under capitalism. They then consider how capitalism needs world money and, at the same time, makes its stable functioning difficult.

They then go on to trace the fundamental instability of the modern international monetary systems based on national currencies of dominant countries, from the gold standard to the current volatile and predatory dollar-centred system, and their close connection to short-term and speculative.

“Weak growth in the global economy, low and negative interest rates, the risk of endless stagnation and rising inflation, and prospects for a prolonged recession are, unfortunately, part of the economic reality. Clearly, the globalisation-based financial supercapitalism model, of which the United States was a beneficiary for quite a long time, and which relied on endless lending and financialisation, which turned the commodity markets into financial ones, has run its course.”

– Alexander Losev from the Preface

Valdai-Paper-116Download: https://geopolitics.co/wp-content/uploads/2022/06/Valdai-Paper-116.pdf

Anti-Russia Sanctions Fallout: A New Bloc Forming Between BRICS and the Middle East

Economists Michael Hudson and Richard Wolff joined CN Live! to discuss the economic war against Russia and its boomerang effect on the West. Does it mean that globalization is over?

Continue reading Anti-Russia Sanctions Fallout: A New Bloc Forming Between BRICS and the Middle East$11 Trillion U.S. Fiscal & Monetary Spending, A Colossal Theft in Plain Sight

What have we done with the $11 Trillion?

Continue reading $11 Trillion U.S. Fiscal & Monetary Spending, A Colossal Theft in Plain SightRising Food Prices Could Spark Famine, War, and Revolution in 2022

The political consequences of hunger are profound and unpredictable but could be the spark that lights a powder keg of anger and resentment that would make the 2020 Black Lives Matter protests look tame by comparison.

Continue reading Rising Food Prices Could Spark Famine, War, and Revolution in 2022Another Housing Crisis in America Is Coming

There is now an unprecedented spike in housing costs while COVID-19 has driven down the wealth of the average American.

Continue reading Another Housing Crisis in America Is ComingGuterres and the Great Reset: How Capitalism Became a Time Bomb

It was always just a temporary social Darwinist age of pillage and hedonism masquerading as capitalism which could do nothing but collapse by its very nature.

Continue reading Guterres and the Great Reset: How Capitalism Became a Time BombWith 60 Million Americans Going Hungry, the United States Needs to Make Peace Not War

The United States cannot afford to maintain a war economy. Such a hyper-militarized economy is inciting dangerous tensions between nuclear powers, as well as eroding the very material foundations of American society.

Continue reading With 60 Million Americans Going Hungry, the United States Needs to Make Peace Not WarThe Chinese Miracle, Revisited

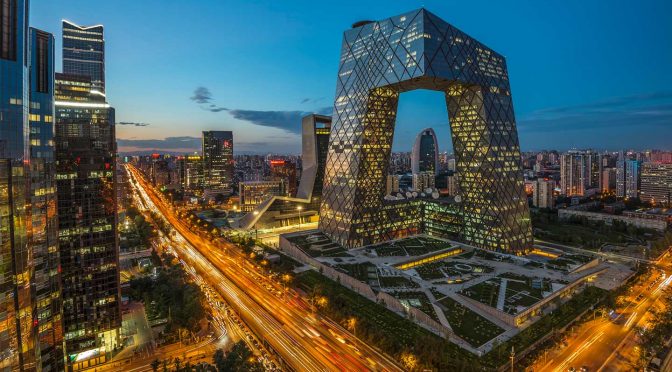

The Chinese Communist Party (CCP) centennial takes place this week at the heart of an incandescent geopolitical equation.

Continue reading The Chinese Miracle, RevisitedBiden’s $2.3 Trillion Infrastructure Capitulation: Stripped Down to $579 Billion

For weeks I’ve been predicting Biden would capitulate to the Republican-McConnell proposals on infrastructure, including funding it without taxing corps-investors-wealthy.

Continue reading Biden’s $2.3 Trillion Infrastructure Capitulation: Stripped Down to $579 BillionTargeting Russia and China Instead of the Real Enemy – Capitalist Inequality

Capitalism and its inequality is the number one enemy of today’s world. That is the objective and empirical reality that is staring the world in the face.

Continue reading Targeting Russia and China Instead of the Real Enemy – Capitalist InequalityLobotomized Economists Clash on the Deck of the Titanic

As the geniuses running the western financial bubble sometimes called an “economy” continue to double down on their obsession to pump a dead financial system with ever more trillions in stimulus spending, arguments are raging among brainwashed economists living in denial over the oncoming systemic collapse.

Continue reading Lobotomized Economists Clash on the Deck of the TitanicThe Return of the Trickle-Down Ruse

Whether owing to the distributional effects of government pandemic policies, the recent victory of President-elect Joe Biden, or perhaps just to the hyper-politicization of the modern day, political speech is reacquiring the language accompanying a left turn in policy.

Continue reading The Return of the Trickle-Down RuseRCEP: World’s Biggest Trade Deal Signed While Deep State Brings U.S. Closer to Civil War

While a civil war is looming in the US, several nations in the Asia Pacific region are silently bringing their economies closer together, and have finally signed the world’s biggest trade agreement ever. This milestone proves that these countries strongly reject the view that a threat of force is the only means of maintaining order in the region.

Continue reading RCEP: World’s Biggest Trade Deal Signed While Deep State Brings U.S. Closer to Civil WarDeutsche Bank Close to Bankruptcy

It seems that collapse of the institution would destroy global financial system.

Continue reading Deutsche Bank Close to BankruptcyOur Grim Future: Restored Neoliberalism or Hybrid Neofascism?

With the specter of a New Great Depression hovering over most of the planet, realpolitik perspectives for a radical change of the political economy framework we live in are not exactly encouraging.

Continue reading Our Grim Future: Restored Neoliberalism or Hybrid Neofascism?Putin and the ‘Biden Memorial Pipeline’ to China

In early 2014 Washington staged a blatant coup d’etat in Ukraine breaking the historic relationship with Russia and setting the stage for the subsequent NATO demonization of Russia. The one in charge for the Obama Administration of the Ukraine coup was then-Vice President Joe Biden.

Continue reading Putin and the ‘Biden Memorial Pipeline’ to ChinaThe Plan For A Global Dystopia

Global policy planners intend to deliver replacements for both dollar hegemony and fossil fuels. Plans may appear uncoordinated and in their early stages, but these issues are becoming increasingly linked.

Continue reading The Plan For A Global DystopiaRussia Writes Off More than $20 Billion African Debt

Unlike its Western “partners”, which force their client states to perpetual capitulation via onerous debt, Russia released the African population from their debt obligation of more than $20 billion and further promised to double its economic cooperation with the continent in the foreseeable future.

Continue reading Russia Writes Off More than $20 Billion African DebtThe Disaster of Negative Interest Rates

President Trump wants negative interest rates, but they would be disastrous for the U.S. economy, and his objectives can be better achieved by other means.

Continue reading The Disaster of Negative Interest Rates‘Vaguely Troubling’: BIS Warns Of Disaster Re $17 Trillion Negative-Yield Debt

When the central bank for central banks publishes its quarterly review, the world should take note.

Continue reading ‘Vaguely Troubling’: BIS Warns Of Disaster Re $17 Trillion Negative-Yield DebtDesperate Central Bankers Grab for More Power

Conceding that their grip on the economy is slipping, central bankers are proposing a radical economic reset that would shift yet more power from government to themselves.

Continue reading Desperate Central Bankers Grab for More PowerFederal Reserve Intervenes with Massive Repo to Inject Cash into Money Markets

For the first time since 2008 the private central bank Federal Reserve has intervened in the money markets due to “unusually high demand for cash,” that sends borrowing costs soaring high, with massive $53 billion repo on Tuesday, and another $75 billion on Wednesday.

Continue reading Federal Reserve Intervenes with Massive Repo to Inject Cash into Money MarketsActual US Debt May Be $400 Trillion, or 20 Times GDP | Wall Street Report

The last combined debt figure was $200+ trillion. Now, a new Wall Street report says it’s actually 2000% of US GDP. Yet, the US government still has maintained its $750 billion annual Pentagon budget. How can the Americans tolerate that?

Continue reading Actual US Debt May Be $400 Trillion, or 20 Times GDP | Wall Street ReportThe World is Dedollarizing

What if tomorrow nobody but the United States would use the US-dollar? Every country, or society would use their own currency for internal and international trade, their own economy-based, non-fiat currency. It could be traditional currencies or new government controlled crypto-currencies, but a country’s own sovereign money. No longer the US-dollar. No longer the dollar’s foster child, the Euro. Continue reading The World is Dedollarizing

The State of the Economy 2019

The story line is going out that the economic boom is weakening and the Federal Reserve has to get the printing press running again. The Fed uses the money to purchase bonds, which drives up the prices of bonds and lowers the interest rate. Continue reading The State of the Economy 2019

Trump’s Trade War is Already Over

I hate to break the news to China bashers, but the trade war with the US is over. I’ve maintained for months that Trump has no leverage in trade talks with China. If he did China would have done a deal by now. Continue reading Trump’s Trade War is Already Over

Trade Wars, Peak Oil, Naval Movements and America’s Only Way Out

The Trump government has today upped the ante in its trade negotiations with China by announcing a 25% tariff imposed on $200 billion worth of goods imports from their 10% previous tariff rate. Continue reading Trade Wars, Peak Oil, Naval Movements and America’s Only Way Out

Concentration of Wealth is Driving a New Global Imperialism

Regime changes in Iraq and Libya, Syria’s war, Venezuela’s crisis, sanctions on Cuba, Iran, Russia, and North Korea are all reflections of a new global imperialism imposed by a core of capitalist nations in support of trillions of dollars of concentrated investment wealth. This new world order of mass capital has become a totalitarian empire of inequality and repression. Continue reading Concentration of Wealth is Driving a New Global Imperialism

Obama Appointed WB President Jim Yong Kim Abruptly Resigns, Here's why

The Obama appointed World Bank President Jim Yong Kim has announced his early retirement to make way for a Trump appointed CEO in The Bank. There’s a deeper, behind the scenes maneuvering in the world’s financial sector that is shifting paradigms and people across various organizations. Continue reading Obama Appointed WB President Jim Yong Kim Abruptly Resigns, Here's why

Labyrinthine Trap: What Are We Working For?

“One also knows from his letters that nothing appeared more sacred to Van Gogh than work.” – John Berger, “Vincent Van Gogh,” Portraits Continue reading Labyrinthine Trap: What Are We Working For?

Gold Demand up 42%, Countries Abandon US Dollar Amidst Geopolitical Shift

Central banks around the world are turning to gold as an alternative to the US dollar, which they see as being undermined by America’s aggressive trade policy and geopolitical uncertainty. Continue reading Gold Demand up 42%, Countries Abandon US Dollar Amidst Geopolitical Shift

Cyber Risks, the Achilles’ Heel of Cashless Economies

Newspapers around the globe are telling us that contactless payments are thriving, cash is rapidly disappearing and cashless society is practically around the corner. Continue reading Cyber Risks, the Achilles’ Heel of Cashless Economies

How the Rich Eat the Poor and the World

The 2016 Oxfam Davos Report which the mass media have ignored arrestingly shows that 62 individuals – 388 in 2010 – now own more wealth than 50% of the world’s population. More shockingly, it reports from its uncontested public sources that this share of wealth by half of the world’s people has collapsed by over 40% in just the last five years. Continue reading How the Rich Eat the Poor and the World

Fleeing the Buck

For turning against NATO in favor of the Russia-China-Iran Alliance, Turkey is now being aggressively attacked financially, which forces its currency Lira to plummet in recent days. The fiat US dollar is the only weapon left for the Western Deep State, and it may not be enough to regain control over Eurasia. Continue reading Fleeing the Buck

The Latest US Sanctions Point to a Declining World Superpower

On Monday 6th of August the United States imposed a fresh set of sanctions on Iran. These are intended as a prelude to even stronger sanctions to take effect in November. The clearly stated intention is to break the Iranian governments will to resist American demands, and to cause such domestic pain that the Iranian people Will rise in revolt against their government and bring about the long sought after (by the Americans) regime change. Continue reading The Latest US Sanctions Point to a Declining World Superpower

Russia is Preparing for a “Perfect Storm” in the Global Economy

In addition to our last article “Alliance Launching Final Assault vs. Deep State,” more details have come out from Russia, and this is one of the confirmation that everyone is waiting for. Continue reading Russia is Preparing for a “Perfect Storm” in the Global Economy

ECB Stages Coup Against Legitimate Government of Italy

In an intervention which violated the most fundamental rules of democracy and international law, on May 27 the hierarchy of the European Union (EU) vetoed the “government of change” which was being formed in Italy, and which had just won a clear parliamentary majority from the voters. Continue reading ECB Stages Coup Against Legitimate Government of Italy

Iran Starts Ditching the Fiat Dollar, Turkey Repatriating Gold from US

In the early years of the global effort to defeat the belligerent faction of the Western Deep State, the BRICS Alliance had sought to do it in a manner that would have the least negative impact on the population of the West. More than a decade since, and the West has not changed much. They are still in the stage of talking about the true nature of the problem with utmost eloquence. Continue reading Iran Starts Ditching the Fiat Dollar, Turkey Repatriating Gold from US

The Boao Forum for Asia at the Prospect of the US-China Trade War

On April 8-11, the resort town of Bo’ao, situated on the Chinese island of Hainan, saw the regular economic Boao Forum for Asia (BFA). Let us note the increasing importance of this forum that today is called “the Asian Davos”. This time it was visited by both the former UN Secretary-General Ban Ki-moon (chosen as the chairman of the BFA directors) and the incumbent one, António Guterres. Continue reading The Boao Forum for Asia at the Prospect of the US-China Trade War

Russia and India on the Brink of a Major Trade Breakthrough

Russia and India are long-standing partners with a rich history of mutually beneficial cooperation. The two countries have great trading potential. However, Russian-Indian trade and economic cooperation cannot yet be called very active. This situation is not acceptable to either side, and now Russia and India are working to develop their economic relations. Continue reading Russia and India on the Brink of a Major Trade Breakthrough

Is the Eurozone in a Dead End?

It’s remarkable that the Euro and the Eurozone currency grouping hasn’t fallen apart until now. Greece could have done it in 2010 but it was avoided by extraordinary acts of the Euro governments and European Central Bank. Continue reading Is the Eurozone in a Dead End?