Pain, heartbreak and then…. Recovery!

That’s from their own Thema news network, and that maybe is where the Greeks are headed after the majority in the Greek Parliament voted to have the Troika bailout terms be put to a national referendum.

The Greeks have requested for bailout extension beyond June 30th deadline so they could properly conduct the said referendum, but the Troika just refused to, which in no insignificant terms reflects its true elitist gangster character.

The Greeks will now have to choose between EU slavery and a painful return to its national drachma currency.

Crucial, crazy 24 hours for Greece: Saturday’s timeline (photos)

Never a dull moment in Greek politics… How the situation unraveled on Saturday

1 a.m. PM A. Tsipras, in a TV address, described proposals from Greece’s creditors as “humiliation” and “unbearable” – He said that the proposals would be put to a referendum for the Greek people to decide on July 5.

2 a.m. Depositors run to ATM machines to withdraw their cash. Huge lines in the middle of the night. Continued withdrawals until machines are emptied of cash.

2.30 a.m. German Chancellor Angela Merkel, French President Francois Hollande and European Commissioner Jean-Claude Juncker were notified on the referendum, with the latter reportedly furious when he heard the decision.

4 a.m. The French newsagency reported that the creditors offer on which the referendum was to be based had been recalled. Eurozone ministers would discuss alternative at Saturday’s Eurogroup

9 a.m. The Euroworking Group prepared the agenda for Saturday’s Eurogroup

noon. Reports came through that hotels and other businesses on islands had stopped accepting credit card transactions in the fear that banks would be closed on Monday. Only cash.

1.30 p.m. Eurogroup Chief Jeroen Dijsselbloem’s representative said that a proposal by Greece’s creditors was still on the table.

2.40 p.m. Creditors took back the offered deal, citing PM A. Tsipras’ decision to hold a referendum as the reason. They also rejected the Greek PM’s request for an extension to the Greek program

2 p.m. Deutsche Bank, in an emergency communique stated that Europeans may not approve of Greek PM A. Tsipras’ request for an extension to the Greek program

3 p.m. Αrrivals at Eurogroup

3.30 p.m. Finance Minister W. Schaeuble says there is no basis for further negotiations with Greece.

4.30 p.m. Greece’s opposition leaders eye a united “front” of all the country’s pro-European political forces ahead of the referendum. Reports leak that main conservative opposition leader Antonis Samaras met with Evangelos Venizelos, centrist Potami leader Stavros Theodorakis and would brief socialist PASOK leader Fofi Gennimata.

5.30 p.m. It appeared that Eurogroup had ended, but this was later said to be a recess. Sources said PM Y. Varoufakis was trying to convince his counterparts to extend the program for a month.

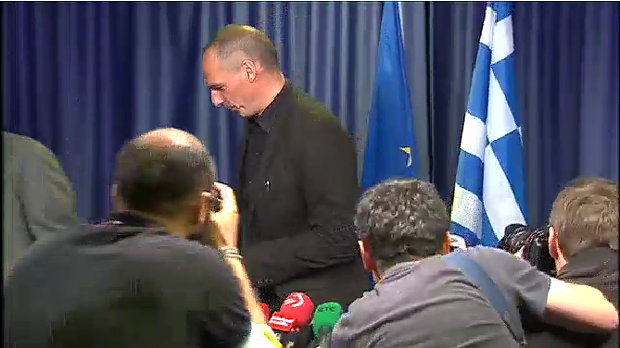

6.15 p.m. In an unprecedented move, Eurozone finance minister kick their peer, Greek Finance Minister Yanis Varoufakis out of the meeting and continue discussions without him.

6.30 p.m. The Eurogroup reconvened with 18 members, discussing the future of Greece without Greece.

7 p.m. Greek Finance Minister Yanis Varoufakis gave a press conference by attacking other Eurozone ministers for not endorsing the Greek request for an extension of the Greek program for a few days to allow the Greek people to vote on their proposals.

7 p.m. Greek Parliament plenary session convenes to vote on whether a referendum will be held on July 5.

7.20 p.m. The Eurogroup issues a statement recallng “the significant financial transfers and support provided to Greece over the last years” as the “current financial assistance arrangement with Greece will expire on June 30, 2015, as well as all agreements related ot the current Greek program.”

7.30 p.m. Main Opposition ND and socialist PASOK reportedly consider tabling a no confidence vote against the SYRIZA-led coalition

9 p.m. Eurogroup Chief Jeroen Dijsselbloem states that though the Greek program will expire on June 30 all other options are open. He stressed that the Greek government walked out of negotiations when these were ongoing.

10 p.m. Unnamed official says the Athens Stock Exchange will not open on Monday if there is no liquidity injection by the European Central Bank via its Emergency Liquidity Assistance Mechanism

midnight Main Opposition New Democracy Leader Antonis Samaras was critical of the government’s decision to call a referendum stating that the agreement presented to the creditors by the Greek government was worse than any previous bailout. He stormed out along with ND ministers after a disagreement with Speaker of the House Zoe Konstantopoulou and then returned almost half an hour later to continue his speech.

1 a.m. PM A. Tsipras delivers a defiant, repetitive, long-winded speech stating that Greece will not be made a “debt colony” for decades to come! Just 24 hours after announcing plans for the July 5 referendum he takes the podium to defend this decision.

2 a.m. IMF Chief Christine Lagarde tells CNBC that Greece will have to pay off the IMF tranche on June 30 and implement reforms, adding that the eurozone is more protected from any fallout from Greece than it had been in 2011.

2.40 a.m. Parliament voted for a referendum on July 5 on the question on whether the proposal of the Institutions (that is now OFF the table) should be accepted or not. The vote count was 178 yes, 128 No and 2 absent.

2.50 a.m. Former socialist PASOK leader Evangelos Venizelos presented a declaration characterizing the vote as unconstitutional, but this motion was overturned by the plenary.

Thema

What’s next for Greece? Pain, heartbreak… and then recovery!

Divorce isn’t as great a tragedy as staying in an unhappy marriage

No sooner did Prime Minister Alexis Tsipras announce the Radical Left Coalition (SYRIZA) government’s decision to hold a referendum on the creditors’ proposals for Greece that the panic began. All hell broke loose as people rushed to ATMs in fear that banks would collapse, cars lined up at gas stations, people rushed to supermarkets to stock up on food and other necessities.

The country is bracing itself for the worst-case scenario that looks likely after the Eurogroup meeting that announced that there would be no extension to the Greek program. If Greece fails to repay 1.6 billion euros to the International Monetary Fund (IMF) on Tuesday it will be cut off from markets. A collision course seems likely as Greece is just a breath away from a Grexit.

Capital Controls

The prospect of default has already resulted in people emptying ATMs and it seems likely that a bank run will be triggered on Monday, just ahead of a formal default.

Greece defaults on IMF payment

In this scenario, Greece would refuse to move its red lines and would not make its debt repayment to the IMF. This would not mean an automatic eurozone exit. Debtors have a 30-day grace period with the IMF. The creditors may be willing to negotiate as they would be the big losers in the case of a default.

Turning to the ECB

SYRIZA is likely to seek aid from the European Central Bank (ECB). The eurozone closing the door on Greece on Saturday and an IMF default however would mean that Greece would have no collateral, essentially shutting down support from the ECB. It remains to be seen whether the ECB would maintain the country’s emergency liquidity funding if the IMF does not immediately declare Greece to be in technical default.

Slow and painful Grexit

Without ECB support, Greek banks would likely collapse and a parallel currency would need to be introduced to cover the government’s domestic obligations. The new currency would be devalued. Unemployment could climb further and Greek companies would close. Tourism would be hit hard.

Social unrest

The July 5 referendum would likely create two camps in Greece rather than unite the nation. The pro-Europe “Yes” group would be at odds with the “No” group bringing about friction, protests, rallies… The government would need to either step down or – in the case of a “Yes” vote – head back to the negotiating table. This time, however negotiations would be even more difficult than before.

Contagion?

The eurozone would suffer and a Grexit may be followed by other exits as markets become nervous. Default would mean a steep loss for the ECB that has already lent 118 billion euros to Greek banks and has spent 20 billion euros buying Greek government bonds. Anti-euro movements would rise in other countries.

Recovery

A number of economists say that a return to the drachma could ultimately benefit Greece. There would be substantial pain but there would also be some benefits. Greece would once again manage its own currency and this would give it a level of control far greater than it has now. It would be good for tourism and would help agricultural producers allowing Greece to expand the service center.

Thema

One of the significant sources of funds for the fascist Nazionist Jesuit Khazarian Mafia is the healthcare industry which registered a whopping $3.09 trillion in 2014, and is projected to soar to $3.57 trillion in 2017, in the US alone.

We can help take down the Dark Cabal by avoiding drugs, defeat any viral attack and scaremongering easily by knowing how to build our own comprehensive antiviral system. Find more about it here.