Recently, the WhiteHats released this video of Lord James of BlackHeath urging the House of Lords to conduct an investigation into a possible bank heist to the tune of US$ 15 Trillion. This is a very significant measure as it is now put on public record, right at the very heart of the British Empire, those “wild rumors” being passed around in the alternative media. The White Dragon Society represented by Ben Fulford is also confirming that a March 31st deadline has been set by the Gnostic Illuminati against the Khazarian Satanic Cabal to transfer power over to Prince Harry before Global Settlements can be implemented.

The transcript of Lord James’ speech above can be downloaded here.

It is our understanding that this amount is separate from the US$16 Trillion being doled out since Obummer was put into office. But reading the GAO Federal Reserve $16 Trillion Emergency Bailout Loans Audit Report suggests both could be related.

To further understand what is at stake in the Global Settlements is to read the details of these documents (including the header) as forwarded to Ben Fulford by a “source linked to the late Philippine President Ferdinand Marcos” and is verified to be authentic, and in fact, signed by both WB President Zoellick, himself, and Hitler’s niece Elizabeth…

Yes, Lord James of BlackHeath’s $15 Trillion bombshell is just a drop in the bucket as the above pages have shown at least US$ 1,464 Trillion to be used for worldwide development as committed to by the real owners of these assets. As the truth about these assets slowly unfolded in the last few months, a wave of increasing pressure mounts against the people in full control of the current financial system.

There are already significant resignations made by CEOs and other high-ranking officials around the globe. Are we now witnessing the downfall of the Dark Cabal?

Will 2012 be the end of the world as we know it?

World Bank President Zoellick Resigns

“I’m honored to have led such a world class institution with so many talented and exceptional people. Together we have focused on supporting developing countries to navigate crises and adjust to global economic shifts. The Bank has recognized that we live in a world of multiple poles of growth where traditional concepts of the “Third World” are now outdated…”

(WASHINGTON) — World Bank President Robert Zoellick said Wednesday he is stepping down, raising the possibility that a non-American might be chosen for the first time to head the 187-nation lending organization.

Zoellick, 58, informed the board he will leave June 30 at the end of a five-year term, during which he led the bank’s response to the global financial crisis.

The board now begins looking for a new president under guidelines directors adopted in 2011 calling for an “open, merit-based and transparent selection” process.

Arrests Made in Italy After Discovery of $6 Trillion in Fake U.S. Bonds

(CNN) — Italian authorities on Friday arrested eight people in possession of an estimated $6 trillion in counterfeit U.S. Treasury bonds, according to Italian paramilitary police and an Italian news agency.

The discovery of the fake bonds — made to look as if they were printed by the U.S. Federal Reserve in 1934 — came about as part of an investigation into a local mafia association.

The arrest order for the alleged criminals was issued by a preliminary investigative judge in the southern Italian city of Potenza, police noted.

Italian authorities, working with their Swiss counterparts, learned about the counterfeit bonds by way of eavesdropping on wiretapped phones, police said.

The total of $6 trillion is more than twice the Italy’s national debt.

read more: http://edition.cnn.com/2012/02/17/world/europe/italy-counterfeit-bonds/index.html?hpt=hp_t3

Four Priests Charged In Vatican Banking Scandal

Italian investigators have charged four priests with laundering money out of the Vatican’s official bank, the Institute for the Works of Religion, the National Catholic Reporter’s John L. Allen Jr. writes.

The Italian daily l’Unita was the first to report that the priests were being investigated for laundering hundreds of thousands of dollars.

It’s the latest in a series of investigations into Vatican finances dating back to 2010. In December of that year, Pope Benedict XVI decreed an updated anti-money laundering law for Vatican finances.

CFO of ANZ Bank Resigns Amid Turmoil

February 16, 2012 | 3:26 am

The chief financial officer of Australia & New Zealand Banking Group Ltd. announced recently that he will resign from the position, a move that will reportedly lead to a significant executive shuffle.

According to MarketWatch, CFO Peter Marriott says he plans to pursue a non-executive career after spending 15 years as the bank’s finance chief. Marriott will officially leave the financial institution on May 1, at which time institutional banking head Shayne Elliott will reportedly take over the role.

This move will lead to a number of other changes, as the bank’s head of Asian operations will take on a larger role to include global institutional banking, while a new chief executive for global wealth management and private banking will also be named.

read more: http://www.proformative.com/news/1470243/cfo-anz-bank-resigns-amid-turmoil

Nicaragua Central Bank Head Quits Amid Row

By Adam Williams and Blake Schmidt – Feb 15, 2012 3:25 AM GMT+0800

Nicaragua’s Central Bank President Antenor Rosales quit amid differences with President Daniel Ortega over plans to use central bank reserves for the creation of a regional bank for a Venezuelan-led bloc of Latin American nations, known as Alba.

Ortega has proposed that Finance Minister Alberto Guevara replace Rosales as head of the central bank, said Edwin Castro, the chief legislator for the ruling Sandinista party, in a statement on a government website today. Castro said the appointment must be approved by lawmakers and didn’t say whether Guevara would continue at the Finance Ministry.

Castro said Rosales’s resignation was “normal government procedure” and not a result of the disagreement with Ortega.

In a Feb. 4 meeting of Alba leaders in Caracas, Ortega agreed to put 1 percent of Nicaragua’s international reserves, or about $17 million, toward the Alba bank, according to a statement on a government website. Rosales told reporters in Managua on Feb. 6 that “no one can touch the international reserves of Nicaragua.”

“The resignation of Rosales sends a bad message to the people of Nicaragua,” opposition legislator Wilfredo Navarro said in comments at the National Assembly broadcast on TV Channel 100% Noticias. “He was defending the legality of the country’s central bank institution. Withdrawing funds for an unknown bank is a violation of the institution.”

read more: http://www.bloomberg.com/news/2012-02-14/nicaragua-central-bank-head-quits-amid-row.html

Switzerland’s Central Bank Chief Resigns

Philipp Hildebrand defends his achievements at financial institution as he bows to uproar over private currency deals.

The Swiss National Bank chairman has resigned abruptly, bowing to a public uproar over his private currency deals.

Philipp Hildebrand’s decision comes just as a Swiss parliamentary committee is preparing to grill him behind closed doors.

His resignation took effect immediately on Monday, Switzerland’s central bank said in a brief statement.

A short time later, Hildebrand called an impromputu press conference in the Swiss capital of Bern, where he emphasised that he was proud of his achievements at financial institutions in Switzerland and international organisations such as the World Bank.

“I would like to think I have been a damn good central banker,” Hildebrand said.

read more: http://www.aljazeera.com/news/europe/2012/01/201219145612935171.html

Credit Suisse’s Private Bank Chief Asian Economist Tan Resigns

February 20, 2012, 1:17 AM EST

By Jonathan Burgos

Feb. 17 (Bloomberg) — Joseph Tan, chief Asian economist of Credit Suisse Group AG’s private bank in Singapore has resigned.

“I have left Credit Suisse,” Tan, who joined the Swiss bank in September 2008, said. “I’m considering my options at the moment.”

Tan previously worked at Fortis Bank SA and Standard Chartered Plc. Credit Suisse spokeswoman Juliette Leong confirmed his departure in an e-mail. Today was his last day, she said.

source: http://www.businessweek.com/news/2012-02-20/credit-suisse-s-private-bank-chief-asian-economist-tan-resigns.html

Embarrassment for Merkel as German president resigns in disgrace after trying to bag the press

- President Christian Wulff is though to be about to leave his office amid an escalating scandal

- He is alleged to have accepted free holidays from wealthy friends, upgrades on airlines and discounted cars

By Allan Hall and David Williams

Last updated at 1:57 AM on 18th February 2012

Germany’s president resigned in disgrace yesterday after failing to gag newspapers investigating him over political favours.

The resignation of Christian Wulff – a victory for Press freedom – is an embarrassing blow to Chancellor Angela Merkel, who had hand-picked her political ally as president.

In a curt statement at the presidential palace in Berlin, Mr Wulff said he had lost the trust of the German people, making it impossible to continue in a role meant to serve as a moral compass for the nation.

He was forced to resign after trying to stop German newspapers investigating a home loan scandal involving more than £430,000 received from a businessman friend’s wife – allegations taken up by prosecutors.

Mr Wulff, 52, whose role was mainly ceremonial, admitted making a ‘grave mistake’ by leaving a message on the answering machine of the editor of Germany’s best-selling Bild newspaper threatening ‘war’ if the daily published a story about his private finance dealings.

Berlusconi Could Get Five Years

Italian prosecutors have demanded a five-year prison sentence for former premier Silvio Berlusconi in his trial on corruption charges.

Prosecutor Fabio De Pasquale urged the court to find Mr Berlusconi guilty of having paid a British lawyer 600,000 dollars (£382,000) to lie in other trials involving charges of tax evasion and false accounting related to the billionaire media mogul’s business dealings.

Prosecutor Fabio De Pasquale urged the court to find Mr Berlusconi guilty of having paid a British lawyer 600,000 dollars (£382,000) to lie in other trials involving charges of tax evasion and false accounting related to the billionaire media mogul’s business dealings.

The court is racing toward a verdict before the charges expire due to the statute of limitations. Mr De Pasquale calculated that would happen by mid-July.

This is one of several cases pending against Mr Berlusconi in Milan courts, including a trial on charges of having paid for sex with an underage prostitute.

He stepped down in November after failing to persuade investors he could revive the ailing economy.

source: http://www.independent.ie/breaking-news/world-news/berlusconi-could-get-five-years-3021249.html

Blankfein out as Goldman Sachs CEO by summer?

Exclusive: Goldman Sachs prepares for life after Lloyd Blankfein, and Gary Cohn is the leading candidate to succeed him as CEO.

FORTUNE — Lloyd Blankfein may step down as chief executive of Goldman Sachs as early as this summer; and president and chief operating officer Gary Cohn is the lead candidate to replace him, according to a Goldman executive and a source close to the firm.

A Goldman spokesman declined to comment.

To be sure, anything can happen over the course of the next few months and the departure of Blankfein, 57, is not certain. It is still up in the air whether Blankfein wants to step down. It would also not be unheard of for Blankfein to share the role of CEO, as so many others at Goldman have in the past. Former co-heads include John Weinberg and John Whitehead; Robert Rubin and Stephen Friedman; and Jon Corzine and Henry Paulson.

But corporate governance experts have emphasized that leadership changes at the nation’s largest financial institutions go a long way toward helping those firms move past the troubles – particularly the reputational damages – wrought by the financial crisis. The feisty Blankfein, the son of a postal worker who grew up in Brooklyn, is one of the only big bank CEOs to have kept his job after the financial crisis. The other is Jamie Dimon, CEO of JPMorgan Chase (JPM).

read more: http://finance.fortune.cnn.com/2012/02/17/gary-cohn-goldman-sachs/?iid=Popular

Bank feud: Chairman Giles quits VNB with other directors

A feud over corporate governance compounded an already painful December for a major Central Virginia financial institution. Virginia National Bank has experienced a leadership shake-up that has seen nearly one third of the board of trustees quit including the chairman, Mark Giles.

“My resignation is effective immediately,” Giles tells President Glenn Rust in a December 19 letter that followed an apparently contentious meeting earlier that day. Neither Rust nor Giles, who spent nearly a decade as the Bank’s first president and who chaired the board since 2005, returned repeated telephone messages.

Two other board members, Ms. Claire Gargalli and Mr. Leslie Disharoon, also quit that same Monday in what the bank concedes was a disagreement over the composition of its board of directors. A fourth director on the 13-person board, Neal Kassell, resigned two days later for unstated reasons.

read more: http://www.readthehook.com/102524/bank-feud-chairman-giles-quits-vnb-other-directors

___

From hereon, you can click on any image to read the corresponding article in full…

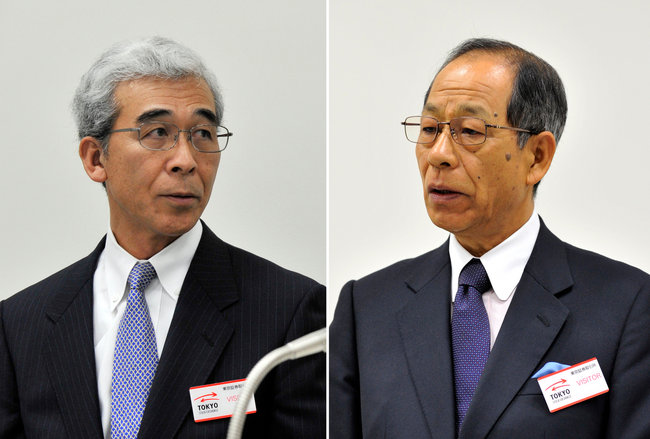

Arrests in Olympus Scandal Point to Widening Inquiry Into a Cover-Up

TOKYO — Arrests of seven people Thursday accused of involvement in the $1.7 billion accounting scandal at Olympus, including the company’s former chairman and executive vice president, point to a widening investigation into a cover-up ostensibly carried out by top management with the help of a group of former bankers.

Tsuyoshi Kikukawa, who was the company’s chairman until the scandal broke last fall, was arrested in Tokyo as were two other former executives on suspicion of having falsified financial statements, Tokyo prosecutors said. Two former Nomura investment bankers who had been previously mentioned by investigators were also taken into custody, accused of violating securities laws, and so were two of the bankers’ associates.

By aiming a spotlight on what critics say is Japan’s lax corporate governance, and casting a shadow over one of the country’s former blue-chip companies, the Olympus scandal has become a test of how far Japan is willing to go to fight white-collar crime.

Korea Exchange Bank Chief Steps Down

SEOUL, Feb. 10 (Yonhap) — The head of South Korea’s No. 5 lender Korea Exchange Bank (KEB) stepped down after completing his three-year term on Friday, and handing over to his successor, the role of completing the deal to sell the bank to a local counterpart.

Larry Klane, the president of KEB, expressed gratitude to his staff at a farewell ceremony held in central Seoul, for embracing a foreign chief “who’s not used to the country,” adding he did his best to draw a brighter future for the KEB in the midst of financial difficulties.

source: http://english.yonhapnews.co.kr/business/2012/02/10/0503000000AEN20120210005100320.HTML

Head of Russian Bank Regulator Steps Down

The head of supervision at Russia’s central bank has resigned after a series of scandals in which regulators failed to detect massive mismanagement in some of Russia’s largest banks. Gennady Melikyan, deputy governor of the central bank in charge of bank supervision, announced he would step down on Sept. 9. He occupied one of the most hazardous jobs in the Russian financial sector – his predecessor Andrei Kozlov was shot dead in 2006 in an assassination-style hit after launching a crusade to…

read more: http://newsley.com/articles/head-of-russian-bank-regulator-steps-down/206711

AJK Bank’s Executive Steps Down

MIRPUR (AJK) – Zulfiqar Abbasi, Member Board of Directors & Member Audit Committee of The Bank of Azad Jammu & Kashmir, has resigned from both his offices as a protest against the non-functioning of the bank in line with the stipulated banking norms, rules and regulations.

Submitting his resignation to the AJK Minister for Finance Ch Latif Akber, who is also Chairman of the Bank of AJK, Mr Abbasi said that for the last two years he had been insisting the AJK govt to mend their ways towards the affairs of the bank of AJ&K since they were trying to run the bank like a govt department with serious irregularities and violations and their handpicked incompetent management.

Saudi Hollandi Banks MD quits

RIYADH: Saudi Hollandi Banks Managing Director Geoffrey Calvert has resigned for personal reasons, the bank announced yesterday. On accepting his resignation at the board of directors meeting held yesterday in Riyadh, it was decided to appoint Dr. Bernd Van Linder, general manager of the treasury, to be the acting managing director of the bank succeeding Calvert.

Mubarak Abdullah Al-Khafrah, chairman of the board of directors, thanked Calvert for his contributions to the development of the bank during his time as managing director. He wished the new acting manager great success. Linder joined the Saudi Hollandi Bank in 2006. He has 12 years banking experience in ABN Amro in different positions.

Ken Ofori-Atta steps down as Executive Chair of Databank Group

Investment banker, Ken Ofori-Atta has stepped down as the Executive Chair of the Databank Group.

He announced his retirement from the investment bank on Tuesday. This will relive him of the day-to-day administration of the firm even though he will stay on as the ceremonial chair.

Mr. Ofori-Atta and Kelly Gadzekpo set up Databank in 1990 and is one of the leading investment banks not only in Ghana but in the sub region. Kelly Gadzekpo is expected to take over as new Chief Executive of the Group.

Mr. Ofori Atta tells JOY BUSINESS he is forced to step down for health reasons.

read more: http://business.thinkghana.com/pages/finance/201202/57429.php

Slovenia’s Two Biggest Banks’ CEOs Step Down as Woes Mount

Nova Ljubljanska Banka d.d. and Nova Kreditna Banka Maribor d.d., Slovenia’s two largest banks, are without chiefs as they struggle with mounting bad loans.

Andrej Plos, the chief executive officer of Nova Kreditna Banka Maribor, who took the helm of Slovenia’s second-biggest bank in January, offered his resignation today without giving a reason. Bozo Jasovic, the CEO of the larger Nova Ljubljanska Banka d.d. stepped down in December over the bank’s attempt to sell the holding in retailer Mercator Poslovni Sistem d.d. to the Croatian rival Agrokor d.d.

“It’s actually hard to believe that the biggest lenders are without a proper leadership in such crucial times for the banking sector and as Slovenia sees its credit rating lowered due to a fragile bank system,” Saso Stanovnik, head of research at Ljubljana brokerage Alta Invest d.d., said in an e-mail today. “One can only hope the new leaderships are in place as soon as possible to tackle the problems of the banking sector.”

Slovenian banks are struggling with mounting losses as the faltering economy pushes more companies into bankruptcy. Lenders in Slovenia, which adopted the euro in 2007, reported 356 million euros ($469 million) of losses last year, the central bank said on Feb. 7.

Social finance pioneer Hayday steps down from Charity Bank

Malcolm Hayday, CEO and one of the founders of Charity Bank, has decided to step down from the post this year.

Under Hayday’s leadership, Charity Bank has grown from concept to launching as the world’s first general registered charity that is also an authorised bank.

This year Charity Bank celebrates its 10th anniversary, with the bank’s balance sheet at the end of 2011 exceeding £80m, an increase of almost 20% on the previous year, and many times the opening figure of £6.4m in 2002. It also expects to report a surplus of over £350,000.

Two Top Morgan Stanley Bankers Resign

NEW YORK (Reuters) – Morgan Stanley’s (NYSE:MWD – news) two top investment bankers resigned on Wednesday, increasing the pressure on Chief Executive Philip Purcell and raising questions about whether the securities firm can remain independent.

The resignations are the biggest blow yet in a battle raging between Purcell and a group of eight former Morgan Stanley executives seeking to oust him.

Joseph Perella, Morgan’s investment banking chairman and company vice chairman and one of the best-known bankers on Wall Street, resigned after 12 years at the firm. Tarek “Terry” Abdel-Meguid, a long-time Perella deputy and the head of investment banking, also quit.

The firm quickly named new co-heads of its Investment Banking Division and said Perella and Meguid had agreed to stay on for an unspecified transition period.

“Morgan Stanley simply cannot be managed if this much turmoil exists within,” Punk, Ziegel & Co. analyst Dick Bove said. “And if it cannot be effectively managed, I don’t see how Purcell can stay at the top.”

Morgan Stanley’s board responded directly to the dissidents on Wednesday, criticizing their campaign and reaffirming its support for Purcell.

At least 10 traders and bankers have left the firm since Purcell shook up management in the securities business late last month. The departure of Perella is especially painful because of his stature on Wall Street and his recent support for Purcell.

read more: http://www.stockbroker-fraud.com/lawyer-attorney-1133774.html

Key Chavez Minister Resigns Amid Banking Corruption Fallout

By Jeremy Morgan

By Jeremy Morgan

Latin American Herald Tribune staff

CARACAS — President Hugo Chavez lost one of his closest and oldest collaborators as Science and Technology Minister Jesse Chacon submitted his resignation after his brother was arrested in connection with the crisis in which state control has been imposed on six banks.

Arne Chacon was arrested by the state security service, DISIP, after three more banks, Banco Real, Baninvest and Central, were “intervened” by the government, in addition to the four banks — Canarias, Banpro, Bolívar and Confederado — that were first taken over on November 20 on orders from Finance Minister Ali Rodriguez Araque. Two stockbroking houses have been raided by Disip and prosecutors since then, one of which is said also to have been put under direct state control.

Brought before a court, Chacon was ordered to be held in custody pending further investigation of his possible involvement in three banks, reports said. Chacon’s brother, the minister, said that when he’d heard the news “I called the president and told him that in these conditions I would prefer to resign so that there would be no doubt about our transparency in this investigation.”

Societe Generale’s Investment Banking Chief Steps Down

By MARK SCOTT Patrick Kovarik/Agence France-Presse — Getty ImagesMichel Péretié, right, the head of Société Générale’s corporate and investment banking division.

Patrick Kovarik/Agence France-Presse — Getty ImagesMichel Péretié, right, the head of Société Générale’s corporate and investment banking division.LONDON — Michel Péretié, head of Société Générale’s corporate and investment banking division, is leaving the French bank to pursue other opportunities.

Mr. Péretié, who held the position for three years after joining the bank from Bear Stearns, will be succeeded by the division’s chief financial officer, Didier Valet, according to a statement from Société Générale.

Two other appointments also were announced. Christophe Mianné will become deputy chief executive of the division, while Bertrand Badré has been appointed its chief financial officer.

Now that we are witnessing these resignations en masse from the players of the rotten system, we can only ask when will the massive arrests begin?

Another question in everyone’s mind is this: Will Obama resign before his term ends? We do believe that either he resigns or be arrested before his term ends. Alan Caruba agrees with an early resignation, like so:

continue reading »» Massive Resignations Have Started v2.0

You can join the fight against the Dark Cabal and accelerate its demise just by boycotting Big Pharma. You can effectively do this by downloading “Towards Healthcare Emancipation“, a fully illustrated do-it-yourself instructional eBook that will help you in implementing all eClinik methods that would negate the use of expensive medicine, avoid radioactive diagnostics and treatments in completely defeating cancer, AIDS and all other parasitic diseases. These methods, when faithfully followed, work 100% all the time. Find out more about this here.

The downfall of the Dark Cabal has a long way to go yet, so it makes a noticeable difference to the well-being of the people of this world.

Are they going to run away and hide or are they going to be prosecuted as they deserve. As they all resign, they all need to be rounded up, charged with their various crimes and jailed.

I guess we can only wait and see!

when do the corrupt asshats in Congress resign?

I agree with you John. Are they stepping down because of the pessure over their crimes or are they all steping down so they can get away clean with their stolen monies?

<a href="http://www.xtranormal.com/watch/13073457/graduation-day" rel="nofollow ugc">http://www.xtranormal.com/watch/13073457/graduation-day

They will not escape…soon to follow will be announcements from our media who will finally be allowed to report on the Extra Terrestrial presence around and within our planet…these beings are benevolent and our government has known about them for about a century if not longer…

…these beings are benevolent and our government has known about them for about a century if not longer…

That’s what the mouse thought when the cat only “played” with it, after being caught by the cat…until it was eaten by same!!!

“ETs” have the capacity to demonstate a certain patience, equal to the length of their existence…but aren’t bound to abide by it. Just because they’ve NOT demonstrated a evil, capricious nature, doesn’t mean they can’t or won’t.

Beware of stangers bearing gifts…

I hope justice will be done to see that all those with the hands in the till are brought to account.R.

it was about time things were getting at this near conclusioin….lately the world is living with too mani illusions…everything on this planet is so FAKE…everybody on this EARTH is “ON THE TAKE”…tons of DIRTY MONEY,by the MAFIAS made…have been CHANNELLED in the THIEVES BANKS safes….tons of FAKE MONEY printed by the banks,…along with FUNNY EXCHANGES PRoDUCTS designed to trick the FOOLS…MANAGERS PAID TO TELL ENORMOUS LIES….MONEY LOST ON THE BANKS CASINOS…the FICHES are bougth from the depositors accounts…they’re being LOST and the TROUBLES mount….on the horizon you can see very clear…the whole world economic system to the END is near!!!…they are HUNGRY AND GREEDYnot to say,,SEEDY…THEIR FALL is APPROACHING F A S T….this VORACIOUS,SOULNESS,i won’t call them people,GOING BUST!!!

http://www.facebook.com/giulyum?ref=tn_tnmn

God Speed-they all MUST be held accountable. Swift justice. I am so ashamed of the United States involvement in this,the penalty for treason is death, as it should be. We so need honor,dignity,respect,values and morals brought back, Love of God and Country restored. ALL Anti-Americans shipped out of here.

Here is a summary of complex research made by a Finnish Academic that outlines in detail economic and financial sabotage directed against the Finnish people by the Financial mafia cartel. She wants support for a lawsuit against them. Any interested party should contact this writer and they will be given the full set of detailed legal documents.

In search of justice – Summary of an international law case in Finland

by Jukka Davidsson

Finland, as so many other countries in Europe as well as in Asia, experienced a devastating economical collapse in the 1990’s. This writer has been researching the event privately and in the Uppsala University, Sweden. The summary presented here is only a superficial scratch of the very complex case. Only main events, outcomes together with the legal analysis will be presented. The huge amount of victims should finally get justice.

This is a story of a country which has been sold to foreign actors i.e. foreign people planned and executed the economical destruction and local top people aided the process. In this sense there are no news compared with other cases.

The background of the developments in Finland lies on the concept of globalization. All capabilities to protect the country were lifted. This is, financial market was opened and local finance inspection was controlled. The so called market forces made everything happen.

The planning of the banking crises began in early state in 1990. First in 1992 when the chaos was well on the way started to happen. In March President Mauno Koivisto invited the top baking executives to the presidential premises. The message of the banks was that they should get rid of liabilities up to FIM 180 billion. When calculated this number with all liabilities the real figure would be about FIM 256 billion. This equals about 45 percent of all liabilities on the banking sector. The plan was accepted and adopted.

The following meeting held with the President Koivisto took place in May 1992. This time the judicial people were invited to the President Koivisto. Although President Koivisto was officially the host of the seminar, the program and management of the seminar was carried out by invited people. The invited group, about 40 people, consisted of the Supreme Court

members, judges from lower level courts as well as professors of law. Finance Inspection

authority was also invited. According to the invitation letter the objective of the seminar was to evaluate and criticize the judicial operations and practice. The outcome of the seminar was the total collapse of the legal system in Finland. The effective remedies and fair trial as legal principles were removed. One study presented the result of the meeting with the following figure – out of about 3000 hearings banks won 2998 and the debtor only two.

Although the period of financial crises consists of several taskforces and publication the third quotable matter is the secret agreement signed in October 1993 between the major banks and the State of Finland. Parties agreed that the buyers were entitled to transfer customers with loans and guarantees to the bad bank Arsenal. The right to transfer was defined through the ownership of companies and through loan agreements i.e. promissory notes and notes of debt etc. It was also agreed that the banks were entitled to transfer certain lines of businesses which are real estate business and any business related to real estate business, other investment business, construction, any retail business, hotel and restaurant business, any business related to leisure business. This meant from bank customer point of view that the banks were entitled to transfer any customer or force the company in bankruptcy. Beside private people about 22 percent of all active companies faced the bankruptcy. According to the bank of Finland provided statistics about FIM 256 billion worth nominal value loans were transferred out from banks. Due to the undervaluation of properties the real amount of stolen property is about 1,7 – 2 times of the nominal value. This is that the stolen value would be about 70 – 90 billion Euros.

Other outcomes besides the lost property values are the decreased volumes in sales, construction etc. The horrified result of this exercise is the increased numbers of suicides, divorces and mental damages and so on.

People have tried to get justice, tried to get the case of their heard by an independent court. So far this has not succeeded. There is, however, one possibility to do. It is the international criminal law based on the universality principle.

The fair trial and effective remedies are the core elements in a constitutional state. In Finland those values were forgotten during the time of banking crisis. The case law provides the proof on that issue. The rulings of the European Court of Human Rights support the comprehension. In the absence of fair trials and effective remedies the trials are useless. Therefore it is important to discuss the additional possibilities how the victims of the Finnish plot would be able to enjoy the benefits of fair justice, claim damages and begin the healing process.

The main are in the international trial would be crimes against the humanity. The crime against humanity is described in the Convention on the Non-Applicability of Statutory Limitations to War Crimes and Crimes Against Humanity of the United Nations as follows: The General Assembly of the United Nations states in its resolutions 2184(XXI) of 12 December 1966 and 2202(XXI) of 16 December 1966 which expresslycondemned as crimes against humanity the violation of the economic and political rights. The Rome Statue of the International Criminal Court is another foundation for the elements of the crime of the crimes against humanity.

Thousands of deaths should be analyzed against elements of crime like causing death by indirect methods or extermination by inflicting conditions of life. Further there are questions concerning serious discrimination, expropriation, crime against humanity of imprisonment, torture i.e. the perpetrator inflicted severe physical or mental pain or suffering upon one or more persons, persecution i.e. the perpetrator severely deprived, contrary to international law, one or more persons of fundamental rights, other inhumane acts i.e. the perpetrator inflicted great suffering, or serious injury to body or to mental or physical health, by means of an inhumane act.

In this context we shouldn’t either forget in this context the United Nations’ Declaration of Basic Principles of Justice for Victims of Crime and Abuse of Power and Principles of international co-operation in the detection, arrest, extradition of persons guilty of war crimes and crimes against humanity. Among other things following requirements are presented by the United Nations:

“Victims” means persons who, individually or collectively, have suffered harm, including physical or mental injury, emotional suffering, economic loss or substantial impairment of their fundamental rights, through acts or omissions that are in violation of criminal laws operative within Member States, including those laws proscribing criminal abuse of power.

War crimes and crimes against humanity, wherever they are committed, shall be subject to investigation and the persons against whom there is evidence that they have committed such crimes shall be subject to tracing, arrest, trial and, if found guilty, to punishment.

The Finnish people are persistent and unyielding. At the moment this process needs international support and some resources. The European international lawyers have accepted the case and they are ready and willing to file the case. The proof and documentation exists. This trial would be partly a trial against the international financial cabal.

source: http://benjaminfulford.typepad.com/

CNN is now reporting that Johnson & Johnson CEO Bill Weldon is resigning effective April 1st.

As they always say, “J & J, a family company”

and I follow up with “not your family though”

Thanks, Jason. We’ve updated the page with your input. ��

This is a possible alternative…

<a href="http://www.reddit.com/r/politics/comments/plr0g/using_technology_to_no_longer_need_money/" rel="nofollow ugc">http://www.reddit.com/r/politics/comments/plr0g/using_technology_to_no_longer_need_money/

I know this probably took a very long time to put together. Thanks

A tricky, testing and a very difficult phase indeed for the Global Banking Industry !

Now since the Economy of the World is interconnected, and the Greed of one Corrupt Indian politician may have a link to an unrestrained ambitions of another near Vatican, so, all this muck we see around must now be fixed and would need a ‘special restructuring’ with an altogether different orientation and it is possible to create a sustainable global civil society when the top Economic and Political Leaders sit across and objectively reflect in sombre manner how first to wipe away the curse of decades old poverty of an individual in society first excluding for the time being, corrupt governments and corporations. ! Every individual can be sustained and supported to a millionaire level and there is nothing to stop this. Finally, it is the Man who made Mansions and a once Glittering Rome, and human race can build this up again and sure, can recreate all the wealth minus the greed of just a few !

Ashok Sharma

New Delhi : India

Click to decode. To finish the decoding make sure that JavaScript is enabled in your browser.">Click to decode. To finish the decoding make sure that JavaScript is enabled in your browser.">wp***@ho*****.com

People need to check this out, very important and disturbing.

Well here we have it folks, the beginning of the end of what will soon be history. As much as humans like to complain, here is a world wide situation that will need our compassion. Not only for those that have been blinded by the cabal, but also for those that will have the vision/courage to set our finances into a state of balance for the good of all.

We mustn’t ignore the fact that there were certain agreements made a long time ago (even if they were distorted as they have now become) with the dark hats, and that each individual “chose” to be here at this time of turmoil for a reason. It is in the Unity of the People that the power now exists, & with that, where in your hearts is forgiveness. Have we learned nothing from the tyranny of being lied to and under the control of the cabal??

Our History has been through many changes and this is the biggest fight of our life with so many people on earth at this time. In the future, our childrens generations and their children will look back on how we handled these injustices.

Our jails are already filled to the max…I ask you > what is another way that we can address these people that filled their life contracts (to our dismay)? There is still so much that will be exposed and irritate us, but we MUST NOT lower ourselves to the levels of negativity that have reigned upon us for so long.

EYES WIDE OPEN

Is the date of the World Bank Group document 2010?

Just above the three signatures it says:

“Sealed and Prepared by the Right Wing Parties of the Committee of 300 on this 4th day of February, 2010 at the WB Headquarters, Washington, D.C., USA. “

Finally someone sees outside the box.

Depuis fort longtemps que je vois qu’est-ce qui se cogite et que les conséquences qui se déambulent autour de nous se résume par des crises qui prennent des ampleurs proportionnellement à la concentration des pouvoirs autour de ce qu’on nomme le “capital” argent mais aussi du travail qui n’ont plus de réalité avec le quotidien mais au contraire pour un projet mondiale où la population n’a pas mot à dire ni ne peut dire mot sans en subir les conséquences localement car la tentacule s’est répandue à toutes les sphères du quotidien et de la vie familial, travail, information, éducation, morale, religieuse, sciences, santé, etc…

Resignations @100 times mo than reported 20,000+ Data from SEC

The Securities Exchange Act of 1934 requires that publicly traded companies must

report to the SEC whenever a member of the Board or certain officers resign.

Also, the SEC has a database named EDGAR that is open to the public. After a

little research, what was discovered is that corporations must report said

resignations on Form 8-K, Item 5.02. From there, it was a simple matter of

searching only Form 8-Ks within a specific range of dates, and including the

boolean search terms “Resigns” and “Resignation”.

I felt this would at least offer us a baseline comparison to see if there is

truly an uptick in resignations, or if it just appears that way. I think you

will be interested in the results.

From the start of 2008 to the second quarter of 2011 the resignations remained

steady @ about 2000 per quarter. Suddenly in the 3rd quarter of 2011 they

increased by 50% to 3000 for that quarter. (That’s an extra 1000). Then in the

4th quarter they jumped to 7000. (That’s an additional extra 5000 resignations).

Now without the full quarter results for the first quarter of 2012 they are up

to 16,000. (That’s an extra 14,000 resignations & increasing fast).

That’s a total of 20,000+ extra resignations that no one is reporting in news

papers & nothing of course in the major media!

I don’t think the mainstream media would go down as deep as what you just did, unless of course, it serves their interests or their patrons agenda.

Thank you for the information, Kennyj. This certainly adds to our education.

Thank you for that information.

It does very little in the way of justice for what they have done and most have parted with the golden handshake. Perhaps today they are living off a massive pension and own one of the many beautiful island around the world.

– A Second Chance For America…

Watch the video…. It’s only about 3 minutes. Spread the word, post on other sites and e-mail to your contacts and participate in the co-creation of our new world… http://www.youtube.com/watch?v=PhCZN-QCvIA

Visit us at http://Notice-Recipient.com or http://Office-of-PMG.com –

Are you still functioning as the video footage and your website cannot be viewed?

Professor Stephen Palmer certainly knew about this for sometime now! He told me in a brief statement that this was going to happen! He is the Grand Master of the White Knights of Malta!

EM: Click to decode. To finish the decoding make sure that JavaScript is enabled in your browser.">Click to decode. To finish the decoding make sure that JavaScript is enabled in your browser.">pr**************@ya****.ru

so the question still remains what is going to be their punishment, after so much financial chaos and misery these bastards caused to humanity around the world?

5 years in jail is a slap on the face of all people that has been afected by all these parasitic beasts, on two legs. death is what every one of them deserve and done publicly so, that all that want to be bankers can learn what will happen to them if they deside to go rouge, on humanity.

This is all OLD NEWS, 2010-2012 at best, in case you haven’t noticed its 2019!!and have we noticed any difference in the Central Bank scam world wide…NO,

so a lot of fuss and sackings and golden hand shake resignations etc, to take the heat off of these deceiving Mercantile thieves.

Quite correct there Rodney although the article does say 2010. They have all left with the golden handshake an utter disgrace and replaced with a new puppet. Same systems of untouchables again formed. Why are banks immune as a private corporation to government and yet all others are not? When will the sheep wake up to this arrangement.

Central banks of countries worldwide should be owned and run by the governments of their respective countries. But now we also know that all these governments are puppets too, do we continue to listen to anything they say or do we alienate ourselves from ‘The System”?