The financial crash is already happening and the central banks are visibly panicking, they are now resorting to negative interest rates for the first time!

They strongly believe that with this scheme, the middlemen lenders would be forced to lend more to their clients to spur economic growth. Otherwise, they will be charged for parking their money with the central bank.

Bank of Japan, in a Surprise, Adopts Negative Interest Rate for the First Time

Keith Bradsher

As Japan’s economic doldrums have lingered, its leaders have tried a number of tricks over the years, from increasing government spending to flooding the financial system with cash.

With the global economy looking increasingly fragile, Japan is now taking a more aggressive step by cutting interest rates below zero on Friday.

The policy — which means banks are essentially paying for the privilege of parking their money — represents a last resort for a country that has struggled through a quarter-century of weak growth. In theory, negative rates will push banks to lend more to companies, which would then spend and hire.

The Bank of Japan is following other central banks in going negative on rates, a sign of the continuing global trouble from plummeting low oil prices, stalling international trade and slowing growth in China. Japan’s prime minister, Shinzo Abe, is seeking new ways to break the country’s cycle of decline.”

http://www.nytimes.com/2016/01/30/business/international/japan-interest-rate.html

The importance of Japan’s economy is borne from the fact that it has been feeding the Khazarians’ pocket for almost a century, the most significant of which was during the Second World War, when it raped China of its historical gold bullion and placed it in the Philippines and some other parts in Southeast Asia. The Khazarians then built an industrial empire out of the Asian loot and in the defeated country, while another victim of the Jesuit-sanctioned Japanese military misadventure across Asia, i.e. the Philippines, is supplying the industrial empire with raw materials even up to now.

Yes, the Jesuits controlled both sides of the conflict as they have always been for the last four centuries.

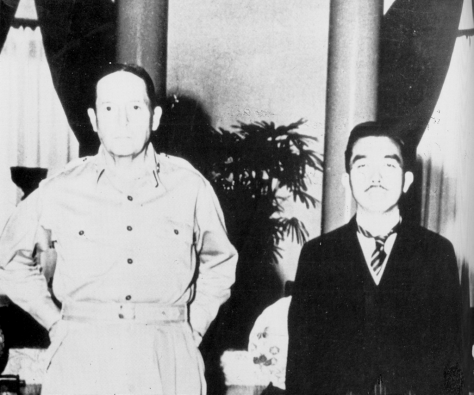

Below, are Maltese Knights Gen. MacArthur and Emperor Hirohito.

No wonder that, for decades, the West has been buying Japanese consumer products at much lower prices than those made at home. Along the way, the Khazarians still thought it wasn’t enough and so the Fukushima nuclear extortion had to happen resulting to the prime minister then giving out at least $70 billion, or else the rest of the nuclear plants in the country would explode.

Onward to the last three years or so, Japan’s pension fund was also skimmed to keep the Khazarians afloat amidst ongoing international effort to pin them all down, and now Japan is bowing again to the Khazarian diktats of adopting to the Western ongoing trend of imposing negative interest rates, a desperate move proving the true value of the fiat dollar, i.e. nil.

The basic problem is, the bank borrowers know exactly that the central banks are just printing worthless paper money, and countries like China are now restricting the acceptance of fiat dollar effectively halting the delivery of goods worldwide since December last year.

- International Shipping Shuts Down; Baltic Dry Index Freefalling

- The Unfolding Global Reset that Only Few Understand

Retail Apocalypse: 2016 Brings Empty Shelves And Store Closings All Across America

By Michael Snyder, on January 31st, 2016

Closed – Public DomainMajor retailers in the United States are shutting down hundreds of stores, and shoppers are reporting alarmingly bare shelves in many retail locations that are still open all over the country. It appears that the retail apocalypse that made so many headlines in 2015 has gone to an entirely new level as we enter 2016. As economic activity slows down and Internet retailers capture more of the market, brick and mortar retailers are cutting their losses.

This is especially true in areas that are on the lower portion of the income scale. In impoverished urban centers all over the nation, it is not uncommon to find entire malls that have now been completely abandoned. It has been estimated that there is about a billion square feet of retail space sitting empty in this country, and this crisis is only going to get worse as the retail apocalypse accelerates.

We always get a wave of store closings after the holiday shopping season, but this year has been particularly active. The following are just a few of the big retailers that have already made major announcements…

-Wal-Mart is closing 269 stores, including 154 inside the United States.

-K-Mart is closing down more than two dozen stores over the next several months.

-J.C. Penney will be permanently shutting down 47 more stores after closing a total of 40 stores in 2015.

-Macy’s has decided that it needs to shutter 36 stores and lay off approximately 2,500 employees.

-The Gap is in the process of closing 175 stores in North America.

-Aeropostale is in the process of closing 84 stores all across America.

-Finish Line has announced that 150 stores will be shutting down over the next few years.

-Sears has shut down about 600 stores over the past year or so, but sales at the stores that remain open continue to fall precipitously.

But these store closings are only part of the story.

All over the country, shoppers are noticing bare shelves and alarmingly low inventory levels. This is happening even at the largest and most prominent retailers.

Not only that shelves are going empty across America, in the last few minutes, Nikkei is also reporting that its 10Y Auction is postponed indefinitely due to the same self imposed negative interest rates.

“February 3, 2016 3:11 am JST

Japanese 10-year bonds Sales to individuals to be called off over negative yields

TOKYO — The planned March sale of 10-year Japanese government bonds through banks to retail investors, municipalities and others will be canceled amid expected below-zero yields following the Bank of Japan’s recent move to adopt negative interest rates.

The Ministry of Finance is expected to announce Wednesday the first-ever decision to call off sales of 10-year JGBs.

The JGBs in question are sold through Japan Post Bank and regional banks in 50,000 yen ($415) units. The holder can cash out this new type of bond ahead of maturity. With the ministry already having suspended sales of two- and five-year instruments, all sales will end. But variable-rate 10-year JGBs for retail investors will still be offered.

Winning bids at the ministry’s auction of 10-year JGBs on Tuesday translated to a record-low average yield of 0.078%. As of Monday, nearly 70% of JGBs on the market already had negative yields, according to the Japan Securities Dealers Association.

Corporations and municipalities have started delaying their own issuances. Daiwa Securities Group has dropped plans to set conditions later this week for the issuance of seven- and 10-year straight bonds this month. The brokerage decided to take a fresh look at JGB yields and investor demand and said it has not decided when to proceed.”

This plummeting integrity of the government’s promissory notes is what defines an economic crash, and Japan is just a mirror of the current Western financial condition that is still in grave denial.

This current predicament is compounded by Saudi’s unilateral massive unloading of petrodollar denominated foreign asset holdings, like so:

“The Saudis selling their stocks in the open market en masse, especially in the first weeks of January, spreading panic all around the world, appears to have seriously displeased another faction of the Masters of the Universe. This faction might eventually let everyone know what the secret Saudi position is in US Treasuries. Remember, we’re talking about at least $8 trillion.

The House of Saud, predictably, is in total panic. Imagine a leak stating they are sitting on $8 trillion while asking the poor in Saudi Arabia for economic “sacrifices” to support their oil price war plus the unwinnable war on Yemen, fought with expensive mercenaries. A global uproar would be inevitable — claiming a freeze on Saudi assets that are being used to destroy world markets. A barely concealed secret is that the House of Saud is not exactly popular in all the crucial places, from Moscow to Washington and Berlin.

The House of Saud cannot possibly believe that the FSB, SVR and GRU deeply love them for trying to destroy Russia; that Texans love them for trying to destroy the shale oil industry; that Germany or Italy love them for dumping a trillion dollars in securities on the markets to crash them as Mario Draghi pumps major QE trying to rescue the eurozone. “

http://sputniknews.com/columnists/20160129/1033920936/saudi-arabia-plays-russian-roulette.html

Saudi is just trying to save its own ass. Here’s why:

“Following Russia’s recent acceptance of the renminbi as payments for oil, we expect more record high oil imports ahead to China,” Gordon Kwan, the Hong Kong-based head of regional oil and gas research at Nomura Holdings Inc., said in an e-mail, referring to the Chinese currency. “If Saudi Arabia wants to recapture its number one ranking, it needs to accept the renminbi for oil payments instead of just the dollar.”

As both the head of the Eurasian Economic Union (and founding member of BRICS), as well as a major energy exporter, Russia is leading the charge against the dollar. And now other nations are following suit: Iran and India announced last month that they intend to settle all outstanding crude oil payments in rupees, as part of a joint strategy to dump the dollar and trade instead in national currencies.

So, what should the Federal Reserve do now that their Saudi friends are leaving their dollar behind in favor of the Chinese Yuan, and their latest pilot testing in Japan is not working?

They just don’t care. In fact, it wouldn’t be too far fetched to conclude that somehow it’s deliberately orchestrated.

“The Fed Wants to Test How Banks Would Handle Negative Rates

As interest rates turn negative around the world, the Federal Reserve is asking banks to consider the possibility of the same happening in the U.S.

In its annual stress test for 2016, the Fed said it will assess the resilience of big banks to a number of possible situations, including one where the rate on the three-month U.S. Treasury bill stays below zero for a prolonged period.

“The severely adverse scenario is characterized by a severe global recession, accompanied by a period of heightened corporate financial stress and negative yields for short-term U.S. Treasury securities,” the central bank said in announcing the stress tests last week.”

…

New York Fed President William Dudley said last month that policy makers were “not thinking at all seriously of moving to negative interest rates.

“But I suppose if the economy were to unexpectedly weaken dramatically, and we decided that we needed to use a full array of monetary policy tools to provide stimulus, it’s something that we would contemplate as a potential action,” he said on Jan. 15.

Fed Vice Chairman Stanley Fischer said Monday that foreign central banks that had resorted to negative interest rates to stimulate their economies had been more successful than he anticipated.

“It’s working more than I can say I expected in 2012,” he told the Council on Foreign Relations in New York. “Everybody is looking at how this works,” he added.

Whatever they want to call it, the fiat financial system is crashing in front of their faces and what they are about to do is just another way of kicking the can one more time, because telling the people the real financial condition would surely put them out of power quickly, or so we believe.

However, and this is what they are counting on, if the Greek reaction to the financial bullying of the Troika is any yardstick, the Khazarian madmen will have no qualms of implementing even harsher “solution” to their crashing empire. In fact, they could even profit from their own defeat from the East with more austerity measures against its own people.

https://www.youtube.com/watch?v=JwEDvXYVE_g

For all practical purposes, street protests don’t work against these psychopaths, in much the same way as one cannot just shout at mosquitoes to repel them. There’s a need to slap them, and slap them hard indeed, for nobody could expect the corrupt and the corrupted to correct themselves without the necessary motivation.

To continue their reign over the multitude they must maintain the entire facade legitimizing the whole fiat enterprise, and already they are laying the groundwork for a cashless society to essentially tie everyone to the computers.

Obviously, with the full digitization of your lifeline they will be able to eliminate privacy and cloaked the true nature of their projected and imaginary power all at the same time. This is the only feasible solution to stay in power and the people will be sold out once again and will continue to have faith in the very system that enslave them.

Understanding this simple truth should empower the victim and the whole fiat enterprise will crumble via non-participation and active counter offensives.

Western populations need not wait for the complete deterioration of their quality of life to the level of the Third World with their apathy.

The East expects the West to clean its own house from all undesirables before a healthy “win-win” collaboration can be expected. The mechanism for this mutual cooperation is already in place.

WALLMART is opening new stores like crazy!!! Lol

They also had 3.8 Billion dolkar profit last year.

Negative interest rates are a huge deal. I hadn’t thought about them not selling bonds, which is just as big of a deal. Also, it’s nice seeing more public acknowledgement of the world avoiding the dollar.

Support for this article is here:

http://www.gold-eagle.com/article/end-game-central-banks-has-begun

My goodness!this is very disturbing!but there is still hope in Saudi Arabia if he pays all her crime by breaking their pact with the zionist.

The Federal Reserve has been accused of embezzling funds using the auction accounts of Treasury securities. <a href="https://www.scribd.com/document/355085824/Embezzlement-by-Federal-Reserve" rel="nofollow ugc">https://www.scribd.com/document/355085824/Embezzlement-by-Federal-Reserve.