There is now a growing body of evidence that the move towards a cashless society is still on track. In fact, with the ongoing fall of the Khazarian Empire, it might be its only option to remain in power in the West.

“Cash won’t be around in a decade, the chief executive of one of Europe’s biggest banks predicted on Wednesday.

““Cash I think in ten years time probably won’t (exist). There is no need for it, it is terribly inefficient and expensive,” John Cryan, chief executive of Deutsche Bank, said during a discussion on financial technology, known as “fintech”.”

http://www.reuters.com/article/us-davos-meeting-banks-technology-idUSKCN0UY259

From Corbett Report, here’s a list of countries that are already moving, or studying a departure, towards cashless transactions.

The War on Cash: A Country by Country Guide

by James Corbett, corbettreport.com

January 27, 2016

Corbett Reporters will be no stranger to the war on cash. I’ve made videos discussing it, conducted interviews about it, written articles examining it and dissected it on the radio.

The war has been waged through mainstream propaganda outlets, TV advertisements and even children’s games.

We’ve heard cash is dirtied by drug dealing, tarnished by terrorism, tainted by tax evasion (heaven forbid!) and just plain dirty. Not to mention sooooo outdated.

Just this week Norway has jumped aboard the cashless society agenda with DNB, the country’s largest bank, calling for a total end to cash. The story only sounds shocking because people haven’t heard the similar stories from Sweden or Denmark or India or Israel or any of the dozens of other countries whose banksters and (bankster-controlled) governments have openly lusted after a world of completely trackable, completely bank-controlled transactions.

But all of these stories, reported piecemeal here and there over the years, doesn’t give the full story about how this “war on cash” is being waged on every continent and in every country by the same banksters that stand to benefit from a cashless world. Let’s fix that by compiling a list of examples from around the world of how cash payments are being regulated, restricted and phased out. The list below will be updated as new stories come in.

If you have a link to relevant news from your own country or know of such news from another country, please let us know. Corbett Report members are invited to contribute to the list by logging in and leaving links to the relevant info in the comments below.

The Cashless Society List

AUSTRALIA – Late last year the Westpac banking group issued a “Cash Free Report” touting the highly self-serving finding that “Over half (53 per cent) of payments currently made in Australia are cashless” (using Westpac online banking services like their cardless ATMs, no doubt). The report goes on to predict that Australia will be cash free by 2022. Meanwhile, the government is readying a cashless welfare system that will allow the government to control what the money is spent on. What could possibly go wrong?

BELGIUM – In 2014 the Belgian government passed new restrictions on cash payments: cash can no longer be used to pay for real estate, and there is a 3000 euro limit on cash payments for other assets (unless purchase second hand).

CANADA – In 2007 the Canadian government stopped allowing payment of taxes in cash at government service centers. In 2010 Passport Canada followed suit. In 2011 56% of Canadians polled said they were happy to live in a bankster-controlled cashless society so the country killed the penny in 2012 and the Royal Canadian Mint started pimping the “MintChip” as a new form of electronic payment that will be “better than cash.” The Mint ended the program in 2014 but the Great White North is still on track to be a cashless society in the coming years.

CHINA – The People’s Bank of China, citing the need to “reduce costs, curb crimes and money laundry, facilitate transactions and boost central bank’s control on money supply and circulation” set up a research team in 2014 “to study application scenarios for digital currency and strive for an early rollout.”

DENMARK – In the 1990s about 80% of Danish retail purchases were made with cash, but these days it’s more like 25%. But if the Danish government has its way, that number will be 0% by 2030. That’s the year the Danish government has set for the complete elimination of paper money in Denmark.

ECUADOR – Last year Ecuador became the first government to launch a digital currency completely administered and controlled by a central bank. Called the Dinero Electronico, the currency can be purchased with cash, stored in electronic wallets on a phone, and can be exchanged by text message.

FRANCE – In the wake of the Charlie Hebdo attacks last year, the French government stepped up its war on cash. In March of last year, French Finance Minister Michel Sapin declared it necessary to “fight against the use of cash and anonymity in the French economy” in order to combat “low-cost terrorism.” As of September 2015 it is illegal for French citizens to make purchases exceeding 1000 euros in cash.

HONG KONG – When it launched in 1997, the Hong Kong Mass Transit Railway’s Octopus Card was just the second contactless smart card system in the world (after South Korea’s UPass). Although originally used to pay for journeys on public transit, it can now be used at convenience stores, vending machines, supermarkets, photo booths and other retail outlets. In 2004 all metered parking spaces in Hong Kong were converted to cashless meters that required Octopus Cards for payment.

INDIA – India is one of the most cash-dependent economies in the world with a cash-to-GDP ratio of 12%, almost four times that of fellow BRICS nations Brazil and South Africa. But it won’t be for long if the Indian government has its way. Last June the Indian Ministry of Finance posted a draft proposal to its website for facilitating the rise of cashless payments in the country. In his 2015 budget speech the Finance Minister declared: “One way to curb the flow of black money is to discourage transactions in cash. Now that a majority of Indians has or can have, a RUPAY debit card. I therefore, proposes to introduce soon several measure that will incentivize credit or debit card transactions and disincentivize cash transaction.”

ISRAEL – In 2014 a special committee headed by Israeli Prime Minister Benjamin Netanyahu’s Chief of Staff Harel Locker released a report examining how to reduce the use of cash in the country. The report advocates reforms (including restrictions and limits on cash transactions) as part of a strategy whose aim is “reduced use of cash, reduced use of endorsed checks, and increased use of electronic means of payment.”

ITALY – In 2011 newly appointed Italian Prime Minister Mario Monti made cash payments over 1000 euro illegal. “What we need is a revolution in Italians’ thinking” Monti told reporters as he announced the emergency decree which was put into law before it was even formally voted on in parliament.

KENYA – Last year the Kenyan government awarded a contract to MasterCard to administer a smart card that can be used to pay for government services and receive welfare payments. Anne Waiguru of the Ministry of Devolution and Planning explained: “Uwezo Fund beneficiaries, Youth and Women Funds disbursements, National Youth Service, Social welfare government cash transfers to families, government food subsidies, hunger safety net cash transfers and cash transfers to orphaned children will be disbursed through the cards,” neglecting to add that the card also gives MasterCard access to the biometric details of 170 million potential customers.

MEXICO – In 2013 the Mexican government banned cash payments of more than 500,000 pesos for real estate and more than 200,000 pesos for cars, jewelry or lottery tickets.

NETHERLANDS – In 2013 the mayors of Almere, Rotterdam and Maastricht engaged in a publicity stunt to promote a campaign encouraging the public to abandon cash. They spent a week without spending any cash, relying solely on debit cards for purchases. The campaign is part of a long term trend away from cash and toward debit payments in many supermakets and other businesses around the country.

NORWAY – Late last week Trond Bentestuen, a senior executive at Norway’s largest bank, complained to the VG Newspaper that the Norwegian central bank “can only account for 40 percent” of the Norwegian kroner in circulation, meaning “that 60 percent of money usage is outside of any control.” There’s only one conclusion, according to Bentestuen: “There are so many dangers and disadvantages associated with cash, we have concluded that it should be phased out.” Don’t worry, though, the nation’s Finance Ministry says it has “no plans to change the law in this area”…for now.

PHILIPPINES – In the Philippines, the government has launched an “E-Peso” project with the explicit aim of “transforming communities into cashless societies.” Touted as “a digital/virtual currency based on the Philippine Peso” its main selling point (according to the E-Peso’s own website) is that: “Since E-Peso transactions are completely digital, everything will automatically be recorded onto the customer’s account activity log.” The initiative is funded by infamous CIA front USAID, which “has awarded a US$25-million, five-year project to a company called Chemonics to support the Philippine government in the promotion and adoption of e-payments in the Philippines.”

SAUDI ARABIA – A MasterCard report on “The Cashless Journey” noted that by increasing the share of debit card transactions in the economy between 2006 and 2011, Saudi Arabia was moving at a faster than average pace toward a cashless society. Commenting on the report, Khalid Hariry of MasterCard noted: “Saudi Arabia is indeed moving at a better than average pace on its cashless journey, which has been significantly spurred along by government leadership. Regulation mandating wages assignment of employees’ to bank accounts has vastly increased access to electronic payment methods for the Saudi population over a short period of time. These changes, coming alongside initiatives to spur acceptance, and a push to migrate payments made during the Hajj and Umrah pilgrimages, can be expected to shift substantial share of consumer payments away from cash in the coming years.”

SPAIN – Citing budgetary austerity and the need to clamp down on tax fraud the Spanish government banned cash payments of more than 2,500 euros in 2012.

SWEDEN – Last year Stockholm’s KTH Royal Institute of Technology released a report stating that the country is on track to completely eliminating cash transactions in the foreseeable future. Noting that there are now only 80 billion Swedish crowns in circulation in the economy (down from 106 just six years ago), the report highlights how digital person-to-person payment technology “Swish” (developed in collaboration with Danish banks) is already transforming the country’s banking sector, where there are now entire banks that do not accept cash. Meanwhile, the Swedish public is being urged to stop using cash by no less a cultural icon than ABBA’s Björn Ulveaus, who brags that the ABBA museum is now a cashless institution.

URUGUAY – Under the “Financial Inclusion Law” which took effect in May 2015 the Uruguayan government has banned all cash payments over $5,000, thus requiring all property and vehicle purchases to go through the banking system. This is part of a wave of such legislation throughout Latin America hailed as a way of “giving the people what they need” (i.e. access to banking) even when (as the very same report notes) “those on the edges of the financial system are distrustful of banks” especially in Uruguay.

UK – In 2014 cashless payments surpassed cash payments for the first time in the UK, with research (from cashless payment provider Kalixo Pro) suggesting that the average Brit only carries £17.79 in cash at any time and 1 in 4 will walk away from if a business doesn’t accept card payment. London buses went cashless in 2014.

https://www.corbettreport.com/the-war-on-cash-a-country-by-country-guide/

Additional information were fed through the comment section, like so:

Hi James, here are a few countries you can add to the list:

Switzerland:

In 2013 Switzerland is proposing to ban cash payments in excess of 100,000 francs.

Russia:

Russia may ban cash payments for purchases of more than 300,000 rubles (around $10,000) starting in 2015 [needs to be verified].

Mexico:

In 2013 Mexico a ban took effect in which cash payments of more than 200,000 pesos were made illegal.

https://www.corbettreport.com/the-war-on-cash-a-country-by-country-guide/#comment-28815

Since 2014, in Belgium it’s illegal to pay cash for fixed assets. And for movable property (except for 2nd hand products) you are restricted to 3000euro.

http://www.mensenrecht.be/nieuws/cashbetalingen-zijn-strafbaar

In the Netherlands i don’t think there are any restriction laws for consumers (yet), except at the border, but they do ‘force’ it through business legislation.

For instance, the price for business owners to deposit cash money to their accounts has (in some cases) gone up 40%. And this was back in 2011! Some banks (SNS) don’t even accept their cash money anymore.

http://www.detailhandel.nl/nieuwsExtern/482/Contant%20geld%20voor%20winkeliers%20te%20duur

So next to all the positive propaganda (security, time, costs, etc.) about the new ways of paying electronically (even mayors who give up their cash money for a week:

- http://www.detailhandel.nl/nieuwsExtern/587/Burgemeesters%20zonder%20cash%20voor%20pin-campagne.html) they (banks/government) also influence consumer behavior by compelling businesses to change their paying possibilities through costs. So businesses are restricting the possibility to pay with cash,

- http://www.gelderlander.nl/regio/nijmegen-e-o/nijmegen/betalen-met-echt-geld-ontmoedigd-1.1598706

- http://www.connexieb2b.nl/actueel/3995/alleen-nog-pinnen-in-telfort-winkels.html

And to complete the circle urge banks to give people who only pay electronically a discount on their bankaccount costs. So to give the consumer another incentive to drop cash.

Back in 2010 the consumers‘ association (consumenten bond) said that in 5 years all cash will dissapear.

Well, it’s not going that fast but we’re moving pretty rapidly.

10% increase of switchcard paying. Increase in contactless (smartphone/watch) paying, 135m purchases. 23% increase in paying with iDEAL.

And (a little off topic) in august 2015 the Netherlands was the first country to test paying online with fingerprint/facial recognition.

https://www.corbettreport.com/the-war-on-cash-a-country-by-country-guide/#comment-28862

It is being promoted as a way to pay bills without standing in long queues. Not sure how many people have taken it up but there was a big campaign to teach people how to use it.

https://www.corbettreport.com/the-war-on-cash-a-country-by-country-guide/#comment-28863

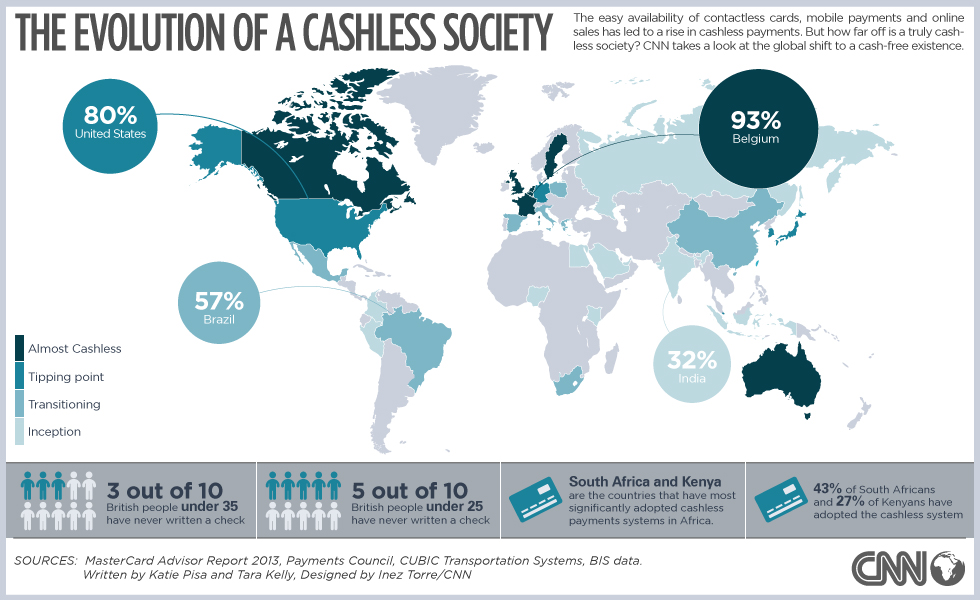

Here’s a 2014 CNN infographic on the “Evolution of the Cashless Society”…

Editor’s note: This infographic is part of CNN’s “Future Finance,” a new series showcasing future trends related to the global financial system. The show complements CNN’s business coverage by examining everything from a cashless society to high-speed trading that employs the power of laser beams. Viewing this from mobile? Click here. Watch the video to find out more about cashless society. (CNN) — CNN.com

Editor’s note: This infographic is part of CNN’s “Future Finance,” a new series showcasing future trends related to the global financial system. The show complements CNN’s business coverage by examining everything from a cashless society to high-speed trading that employs the power of laser beams. Viewing this from mobile? Click here. Watch the video to find out more about cashless society. (CNN) — CNN.com

Analysis

It’s not a complete surprise for us here in the Philippines to be on the above list even if we are part of the ASEAN Community and AIIB economic spheres. But, as we have said much earlier, the Philippine government has been licking American asses since 1898 and Imperial Manila has become so very good at it that nothing America would do that is considered detrimental, or offensive, to the nation.

Our only redeeming opportunity is that, for the last few months, it is the people at the grassroot level that are now campaigning for a hesitant presidential candidate whom they sincerely believe represents their interest based on his 20-year track record that made what Davao City is today, and for all his rhetoric, e.g. he caused a nationwide stir when he publicly cussed the Pope with “Putang Ina” [Motherfucker] after being caught in a heavy traffic caused by the latter’s visit to Manila.

But for Russia and China, two countries that are the prime movers behind the BRICS offensive against the Khazarian Mafia, to be on the above list should give some credence to the concerns raised by the Corbett Report that the world is still marching towards the direction of the New World Order.

There’s no denying that cashless transaction is very convenient and transparent. But transparent for whose vantage point?

Financial automation do have its multiple merits but when the whole system is controlled by a totalitarian entity, then that only makes the whole control process even more efficient.

In the leaked document, “Silent Weapons for Quite Wars,” financial engineering has been serving the Khazarian Mafia its good fortunes for decades while keeping the masses totally oblivious of their slavery. The full automation of this machinery will cause a quantum leap for totalitarian control.

This is the foundation of the Technocratic Dictatorship where all aspects of human survival are effectively tied into the machines. Those who control the machines will always have the upperhand.

This is the reason why those groups of personalities with dictatorial tendencies must be removed first from power before full automation on the entire economy is to be laid out. But then again, what would prevent them from coming back once the whole automated infrastructure is already in place?

They could also simulate their own defeat, say through the BRICS Initiative, only to come back later on. After all we did see Xi Jinping being accommodated at the Buckingham Palace, while Putin was berated at the Vatican Palace by Pope Bergoglio himself, months before Xi’s UK state visit.

This is the reason why we are not buying into the argument that the Khazarian Empire leadership must never be horizontalized outright.

So, when everybody is already hooked up to the machine, because not doing so would make a financial outcast out of them, what would stop the exceptionalists from switching your cashless account off to disable your capacity to live as a way of enforcing State obedience?

By then, the only valid alternative is to depart from the whole mechanism of State control and live off-grid in the countryside. To put it simply, one way of winning this game is via non-participation. But how many of us can afford to live as an outcast?

Another aspect of a cashless society, which is completely ignored by all States listed above, is with a complete departure from any of the prevailing financial systems, i.e. the resource-based economy as advocated through The Venus Project.

The idea of a resource-based economy [RBE] necessitates the complete removal of State controls on most resources through money in favor of their sustainable utilization where planned obsolescence is anathema and the endless pursuit of higher quality of life fully attuned to Nature is cardinal.

In fact, RBE is a complete transformation of the State itself from being a mechanism of control by the few, through representative governance, to one that serves only as a platform for direct popular cooperation. The closest analogy is the Open Source Community where only the best solution dominates naturally through its own merit, and with majority’s consent in real time.

No matter the justification, any form of control against the many in the hands of the few will always be viewed as antagonistic.

Humanity has reached that stage when protests are not just a mere expression of popular discontent, but evidence that the majority are profoundly aware that there is something better than the present.

Multiple groups are now trying to wrestle global control from the Khazarian Mafia. Ben Fulford has said much earlier that the New World Order that the group he represents is particularly trying to put in place is not something as one-sided against the people as the present, but should be in the direction of a Star Trek atmosphere, so to speak.

Similarly, another segment of the Third Force is that one represented by the Keenan Group who committed themselves to releasing free energy, among other exotic technologies.

Whatever the case may be, It is very evident that in the interim a multipolar world is developing and it will be divided along two contrasting capitalist economic boundaries, i.e. Western unregulated capitalism based on fiat electronic currencies, and the BRICS regulated capitalism anchored in a basket of asset-based sovereign currencies. This will be so because of two contrasting philosophies, i.e. Western fascistic exceptionalism and Eastern “win-win” Confusian philosophy.

Unfortunately, the Exceptionalist Doctrine excludes the goyims of the West. This is the reason why even Germany’s Schiller Institute behind the idea of a Eurasian Land Bridge is urging fellow Europeans to march with the BRICS through the New Silk Road revival.

It is definitely high time for us to stand for our own convictions of what the future should be, by assuming more responsibilities to become truly self-reliant and independent, rather than the convenience of just following legislated commands.

Together, we hold the ultimate key to our freedom.

bitcoin, permaculture, aquaculture, self made free energy devices, hydroponics combine with root specialization technique to make it so you don’t rely on money as much http://www.supplysource.com/ or and BITCOIN

So, when everybody is already hooked up to the machine, because not doing so would make a financial outcast out of them, what would stop the exceptionalists from switching your cashless account off to disable your capacity to live as a way of enforcing State obedience?

By then, the only valid alternative is to depart from the whole mechanism of State control and live off-grid in the countryside. To put it simply, one way of winning this game is via non-participation. But how many of us can afford to live as an outcast?(words from this post)—-Indeed.

Why do all writers think you need to pay for anything? You are all conditioned to THINK you need money… MONEY is control… This world will function on supply and demand, no payments required every at all. Babylon will be destroyed in one hour… Think on this … Poverty gone and all the money in the world can’t save their system. Will it happen, YES its only a matter of time… Crash and burn all their control computers, three years of chaos – which they desire for in any case. They will not rise from their money grave…

My friends and I are reaching out to let you know about a new article we recently published which we thought you may find interesting. The article has been printed in several places and we would appreciate you considering it for inclusion on your site, in order to help get this urgent and important message out to as many people as possible. If you wish to include a shortened version with a link to the full story, that’s fine.

The article title is:

“How To Resist Conditioning For The Cashless Society”

The article explores five ways in which people are being heavily conditioned to accept the cashless society – through rhetoric, reason, ridicule, repetition and, lastly, through reality itself. And it concludes with what we need to do in order to take a stand against this.

You can access the article at the following link on our website:

http://www.endtimesurvivors.com/teachings/spiritual-survival/159-how-to-resist-conditioning-for-the-cashless-society

We have also produced a related documentary, which you can view here:

https://www.youtube.com/watch?v=FOOwLaKaDQk

If you decide to publish the article, we would appreciate it if you would consider embedding the documentary on the page at the end (just before the references).

Warm regards,

End Time Survivors

—————————————-

End Time Survivors is a hub for various individuals and groups, where we can share with one another some of the things we have learned in our own search for answers about where the world is heading.

For more information check out our youtube channel at: http://www.youtube.com/EndTimeSurvivors or visit our website at: http://www.endtimesurvivors.com

too many people that are ‘pro-cashless society/system’ are missing the biggest point. The worlds’ Elite/Globalists WANT cashless, because it gives them full control over your money. You never have ‘cash’ in hand. Its a serious issue and its part of their NWO plot. How does anyone not see this? I understand there are ‘benefits’ to it – there are benefits to most things, its all how you look at it. But once a bank has your money and you can’t essentially ‘take it out’ – that doesn’t present as serious issue. The Elite want people to focus on the benefits. Listen, ‘printing paper’ isn’t that big of a deal. Now, cleaning up other emissions is much more important. They can use recycle paper to print money – they are just choosing not to. Our worlds technology has allowing them to get/force everyone onto digital. You know, I was a kid fascinated with technology and I still am. But when you put control of money and technology even in the hands of the greediest, evilest people on the planet – I am sorry, but that does not have a happy ending.

Yes. Totally agree. People are being conditioned to go cashless and they do it blindly. It’s vary clever how they are doing it. They just say in the positive it will happen, and you have no choice and yes, everyday people will be at the mercy of both governments and banks because they will have control of your e- money and charge what ever they want.