At present, there is an emergence of two contrasting geopolitical philosophies. While China is busy strengthening relationships with its neighbors in Asia, and Russia is sending food and medical supplies to the war-torn Ukraine, Western oligarchs are busy sowing terror by proxies everywhere there’s oil, regrouping and enhancing their military command structure as if the East would buy into their warmongering habits.

The recently concluded robbery of the Scottish right to self-determination only shows that Asia could not trust the words of the Rothschild dynasty and that of the Black Nobility. The White Dragon Society’s position to strike a peaceful resolution to the global stalemate between the East and West will never work as the latter is so addicted to power which it never had in the first place.

What these Western Oligarchs have in common is only the capacity to manipulate, and are not ready to cooperate with anybody, other than themselves, for peaceful coexistence and mutual progress. Any group striking a deal with them for purposes of sharing power is either bereft of basic intelligence or outright lunatic.

People around the world would be a lot better without them. It is time.

For actively pursuing a more meritocratic society, both Russia and China are now considered the new enemy by traditional superpowers.

THIS IS WHY RUSSIA & CHINA ARE NOW “THE ENEMY”

source »

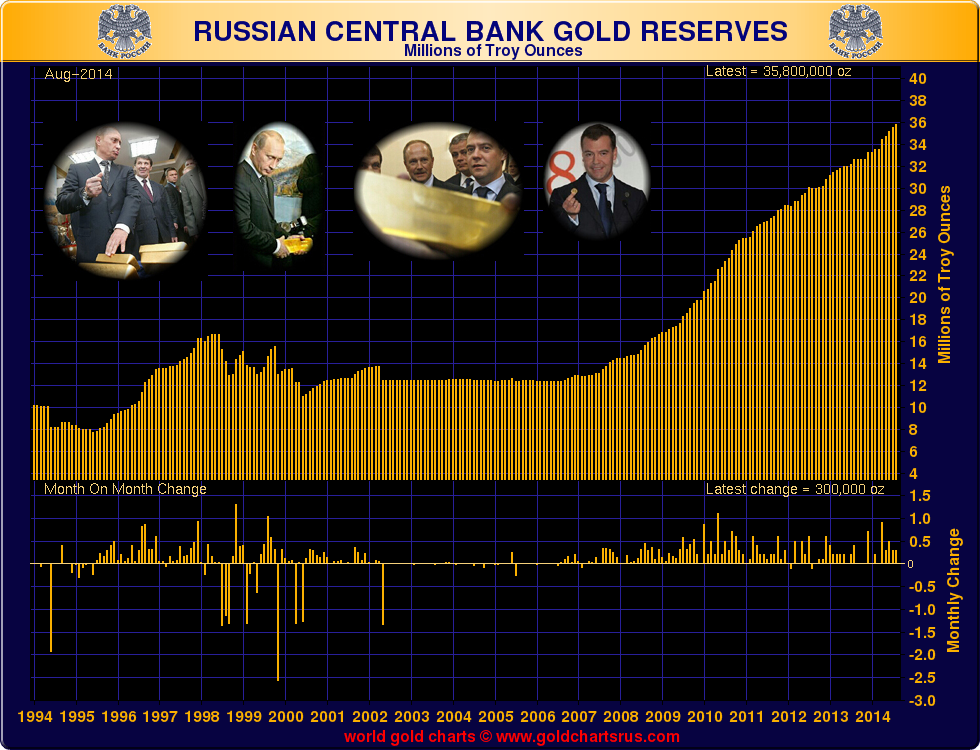

Russia FinMin Calls For Shift Away From US Treasury Into BRIC Bonds, Settlement In Non-Dollar Currencies

Submitted by Tyler Durden on 09/20/2014 21:43 -0400

It is the same BRICs that, Russia’s Prime Minister Dmitry Medvedev, told Rossiya TV in an interview earlier today, should conduct transactions in national currencies, bypassing cross-rates with the US Dollar, adding that “we can easily make mutual settlements directly,” and the mechanism should be beneficial to both sides of transactions.

And if it wasn’t clear by now, Russia pivot away from the west and toward China is pretty much complete. Medvedev also said that “our collaboration with China is of strategic importance. We have great, brilliant political contacts, we have excellent economic relations. [China] is our strategic partner, and we are interested in expanding the volume of cooperation. We are not afraid of collaborating because we are confident that this is equal, friendly and mutually beneficial collaboration in all areas.”

Meanwhile, regarding escalating Western tensions, the PM said that sanctions have created a bad situation for Russian banks on financial markets, all sources of liquidity are frozen. “We regard this as a senseless and ugly decision toward Russia, but we’ll manage without it.” So does that mean that China will step in to provide the required FX reserves as Russia minimizes its USD exposure? Perhaps, but not entirely: Medvedev did add that “Asia, other markets “unlikely fully” to compensate for frozen European financing.”

The PM also said that Russia passed through similar squeeze in 2008-2009 and can manage with central bank resources, adding that Europe is still important market for Russia, if EU members “make no absurd decisions to squeeze us out of this market, we’ll stay there, it’s interesting for us.”

But while Medvedev was the good cop today, it was Russia’s finance minister Anton Siluanov who was the designated “bad guy”, and as the WSJ reported, Russia is considering diversifying its debt portfolio away from countries that have imposed sanctions on Moscow and into the papers of its BRICS partners.

Speaking on the sidelines of an annual investment forum in the Black Sea town of Sochi, Mr. Siluanov said the Finance Ministry wants to diversify its investment basket, and is looking for higher yields without too much risks. He said the ministry will consider buying papers issued by Brazil, India, China and South Africa, which along with Russia are known collectively as the Brics countries.

“[We would like to] walk away from investing in papers of the countries that impose sanctions against us,” Mr. Siluanov said, adding that the reshuffle would be carried out gradually. He didn’t elaborate on when the first purchases of BRICS debt may take place.

The good news for the US, now that Russia appears set on either rapidly or slowly selling off its US Treasury exposure, is that Kremlin has possession of only $115 billion in US paper, which happens to be more than the $100 billion it reported in May when the first shock of a Russian bond sell off hit the market, and both of which happen to be amounts the Fed can easily monetize into its record big balance sheet (which, taper or no taper, just grew by $28 billion in the past week alone) in just over a month.

But at the end of the day it is not what Russia does, but what its other BRIC peers and US Treasury holders do. Because while Moscow may be in possession of just over $114.5 billion in US paper, China, Brazil and India share among them some $1.6 trillion in US Treasurys, better known as “leverage” in every sense of the word, or an amount that not even the Fed could monetize on short notice without sending a massive shockwave through the global capital markets.

In other words, while the US pushes Russia hard, it may be careful not to push it too hard, and in the process start an avalanche that leads to a BRIC bond avalanche, which may well be one possible endgame as the world is forced to transition from the US Dollar as a reserve currency in the coming years.

continue reading »

Would you like to like to have your own eClinik at home?

With this eBook, you can easily defeat cancer, AIDS and help your body cure all known and unknown illnesses without using drugs, at the comfort of your own home. This is our experience.

Find out more about it here.

Every download of our eBook, Towards Healthcare Emancipation – Premium Edition, provides additional funding to our next project.

If you haven’t done so, please like our FB page to encourage others to learn more about our work.

Thank you very much for your valuable support. Mabuhay!