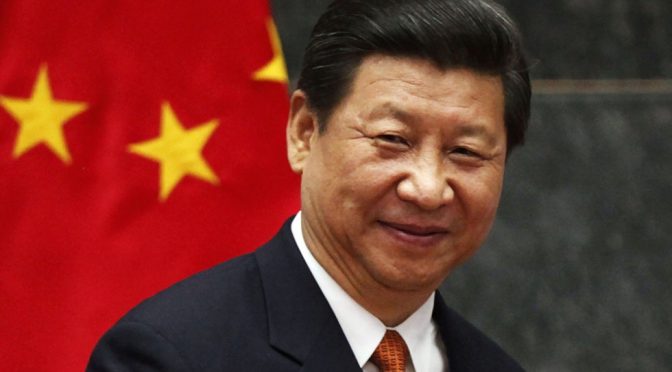

Xi Jinping is touted to be a reformist even before he came in to power. It appears he still is.

Rafael Hui and Thomas Kwok found guilty of bribery in Hong Kong’s biggest graft trial

Kwok’s younger brother, Raymond Kwok Ping-luen, was acquitted of all his four charges. He now takes sole charge of Sun Hung Kai Properties, the city’s biggest property developer by market value, as its chairman.

Red-eyed and weary, the 61-year-old walked free from the High Court alone as two other co-accused were also found guilty.

“I have conflicting emotions,” he told the media circus waiting outside court. Thanking his wife, mother, children and God, he added: “On the one hand, I’m happy … I’ve been proven innocent after these two years of struggles. On the other, I’m very unhappy because Thomas Kwok and Thomas Chan … are convicted. We will continue to support [them and their] families.”

Rafael Hui (left) and Thomas Kwok at court this morning to hear the verdicts.

Rafael Hui (left) and Thomas Kwok at court this morning to hear the verdicts.Thomas Kwok, 63, was convicted of one count of conspiracy to commit misconduct in public office. The brothers’ top aide Thomas Chan Kui-yuen, 68, was found guilty of two counts – a fate shared by ex-stock exchange official Francis Kwan Hung-sang, 64.

Last night, SHKP said Thomas Kwok and Chan would appeal against their convictions. Both resigned from the property giant after the verdicts.

The man at the centre of the storm, Hui, was convicted of five out of eight charges, making him the highest-ranking official in Hong Kong’s history to be convicted of taking bribes.

TIMELINE: Rafael Hui: the rise and fall of a political powerbroker

The case marked the dramatic fall of a man who was once the most influential and decorated star in local politics. Failing to escape the long arm of the law, a fragile Hui, 66, nodded blankly in the dock yesterday as the jury delivered its verdicts at 2.45pm.

Chan, who sat behind Hui, turned red in the face, while Raymond Kwok laid a hand on the shoulder of his elder brother. As he prepared to leave the dock, Raymond paused to speak to the court guards, as if to confirm he really could go.

SHKP boss Raymond Kwok was acquitted of all four counts.

SHKP boss Raymond Kwok was acquitted of all four counts.

All four criminals were taken away by Correctional Services Department officers. They may be sentenced as soon as Monday when Mr Justice Andrew Macrae hears mitigation pleas. By last night, Hui and Kwan had yet to decide if they would appeal.

Macrae ordered a doubling of fees for the nine jurors to HK$820 a day, meaning each could claim about HK$100,000 for their work on the case. He exempted all nine from jury service for five years, thanking them for showing “why retention of the jury system is so important in the city”.

The case, lasting 131 days, was a close fight to the end. The jurors alone took five days and four nights to make up their minds, and had to seek directions from the judge once. And although four of the five were convicted, only 10 out of the 19 verdicts were in favour of the prosecution.

DON’T MISS: How bribe-taker Rafael Hui’s taste for the high life led to his fall from grace

“[Thomas Kwok] considers the verdict very strange,” his lawyer Lawrence Lok SC said outside the court. “Why were some defence arguments accepted but not others, when they were part of the same thing?”

Of Hui’s five convictions, three counts were about misconduct in public office. He concealed from his public-sector employers financial benefits totalling HK$16.582 million.

Thomas Chan, one of two men who helped facilitate Thomas Kwok’s money transfers to Hui, was convicted on two counts related to bribing a public official.

Thomas Chan, one of two men who helped facilitate Thomas Kwok’s money transfers to Hui, was convicted on two counts related to bribing a public official.

Thomas Kwok was convicted of paying Hui HK$8.5 million, via middlemen Chan and Kwan, days before the latter became chief secretary in 2005. All four were found guilty of conspiracy to commit misconduct in public office in a 7-2 jury decision. But the Kwoks were cleared of involvement in HK$11.182 million in bribes for which the other defendants were found guilty.

The billionaire brothers and Hui were cleared of paying HK$5 million and HK$4.125 million in bribes in 2005.

The Independent Commission Against Corruption said it would continue to exercise the law “regardless of the background, status and position of the persons involved”. SHKP and two listed subsidiaries, Smartone and Sunevision, were suspended from trading at 2.45pm.

Additional reporting by Enoch Yiu, Julie Chu and Thomas Chan

Hong Kong graft investigators swoop on unit of Chinese finance giant Guotai Junan

Samuel Chan and Sophie Yu

Hong Kong-listed subsidiary of mainland investment giant is at centre of investigation as its executive director is taken away by the ICAC

Independent Commission Against Corruption investigators swooped on the Central offices of Guotai Junan International, the local subsidiary of Guotai Junan Securities, on Monday. They seized “certain securities trading account-opening records and an agreement relating to a placing case”, the company said in a statement to the stock exchange.

Sources said the investigation was related to a recent share placement. Company chairman Yim Fung could not be reached for comment last night.

Officers also executed a search warrant at the home of Wong Tung-ching, the company’s chairman and executive director, the statement added.

Michael Sze Cho-cheung says it has been difficult for the ICAC. Photo: Edward Wong“Wong was invited to visit the ICAC to assist in an investigation,” the company said. No other director or employee was “taken away”, it added.

Michael Sze Cho-cheung says it has been difficult for the ICAC. Photo: Edward Wong“Wong was invited to visit the ICAC to assist in an investigation,” the company said. No other director or employee was “taken away”, it added.

Trading in the company’s shares resumed yesterday after a two-day suspension pending the release of “price-sensitive information”. Shares fell 7.6 per cent to close at HK$5.69.

Shanghai-based Guotai Junan Securities is one of the mainland’s largest brokerages and asset managers.

The high-profile case broke on the day the ICAC reported that the number of corruption complaints had fallen for the third consecutive year. But officers denied the 11 per cent fall was due to a loss of public confidence in the watchdog after claims former commissioner Timothy Tong Hin-ming breached rules with his lavish hospitality spending.

“The year has been difficult for the ICAC, as we all know. The internal governance of the ICAC was questioned,” said Michael Sze Cho-cheung, chairman of the ICAC’s operations review committee. But he said the institution, which celebrated its 40th anniversary in February, would rebuild its battered reputation.

“The ICAC has been very successful in tackling its problems. I am confident that the public will soon have the same level of trust … as before,” said Sze, who will retire this month.

And Sze said the public need not worry that the ICAC’s highest-profile investigation, into allegations former chief executive Donald Tsang Yam-kuen accepted favours from tycoon friends, would simply “vanish”. The 21/2-year-old investigation could not be wound up without the approval of his committee, which examines all investigations the ICAC is proposing to drop.

Holding its annual year-end media conference yesterday, the agency revealed that complaints received from January to last month were down 11 per cent to 2,190 cases, from 2,452 in the same period last year.

But Sze said there were no signs of worsening cross-border corruption. Complaints regarding cross-border affairs edged up to 32 from 28 for the first 11 months of the year.

Additional reporting by Ray Chan

source »

Just found this blog/post http://netteandme.blogspot.pt/2014/12/meet-robert-lawrence-kuhn-illuminati.html related to China´s president.