As many know by now, the Deep State’s financial power and influence are leveraged in part on the petrodollar that is itself anchored on the oil production of Saudi Arabia, among other smaller oil producers in the region, and in the war industry itself. Both sectors are now being compromised. Continue reading Deep State Desperation Surges Sky High Anew

Tag Archives: us shutdown

Nuke False Flag Averted by 4 US Generals

As some of you may have known we’ve been attacked with an earthquake machine once again where we are still counting the dead up to this point.

Then this update from Keenan came in 2 days ago, about the four generals who stood their ground to avert a nuclear false flag.

ARVE Error: need id and providerARVE Error: need id and provider

The situation is so tense at this point but it is undeniable that the good guys are winning. We just need for people who are lurking to hijack the gains of the revolution.

Take care everyone.

–

We have just released the Second Edition of Towards Healthcare Emancipation eBook. The proceeds from this book will be used to fund our next project, Towards Energy Emancipation.

The aim is to make the subject of free energy more understandable for the layman so that anybody could replicate and install his own power plant and be completely living off-grid.

If you haven’t done so, please like our FB page to encourage others to learn more about our work.

Thank you very much for your valuable support.

London & Beijing Agree to Avoid Dollar

After the successful entry of the yuan into the ECB, the financial center of the planet has opened its doors to the Chinese currency, further eroding the integrity of the “valueless” US dollar.

The UK government has agreed to China’s banking expansion into their territory. Initially, London-based investors are given the opportunity to buy up to 80 Billion Yuan worth of Chinese stocks, bonds and other financial instruments.

Both sides have agreed to trade only in yuan effectively avoiding the US dollar.

There’s a healthy debate going on whether this is good for the US or not.

If China Moves Away from Holding Dollars Then It Will be Doing What Bush-Obama Requested

Tuesday, 15 October 2013 05:03

“The Washington Post had an article reporting on a commentary from a Chinese government owned news outlet that implied the country might move away from holding dollars. The article should have pointed out that such a move would be consistent with the publicly stated demand of both the Bush and Obama administrations that China stop “manipulating” its currency.

The way that China would “manipulate” its currency (keep its price down against the dollar) is by buying up huge amounts of dollars. If it sold dollars then its currency would rise against the dollar. That would make Chinese imports more expensive for people living in the United States, causing us to buy less of them. It would make U.S. exports cheaper for people living in China, leading them to buy more U.S. exports.

This change could go far toward reducing the U.S. trade deficit, especially if other developing countries follow China’s lead as they have in the past. The result would be millions of new jobs and also an important boost to wages. In other words, if China follows through on the path suggested in this article it would be good news for most of the country. Importers like Walmart and companies that have established production facilities in China, like General Electric, might be less pleased.”

London to become Chinese offshore banking centre

Britain has relaxed stringent rules for Chinese banks willing to set up in London. Beijing in turn opened up its markets to British-based investors, marking the latest move to establish the yuan as one of the world’s key currencies.

“A great nation like China should have a global currency,” said UK Chancellor of the Exchequer, George Osborne, during his official five day visit to China. And the UK is gladly willing to contribute “through the international center of finance: London”.

Under the agreed pilot program, China sanctioned London-based investors to buy up to 80 billion yuan ($13.1 billion) of stocks, bonds and money market instruments directly, avoiding Hong Kong transactions, Reuters reports.

Meanwhile, Britain will let Chinese banks set up wholesale branches in London, easing regulations the country had imposed after the financial crisis broke out. Since 2008, Britain has insisted that most foreign lenders should set up their UK operations as “subsidiaries” rather than branches, which provides greater protection for depositors and taxpayers. Less regulation will be welcomed by Chinese lenders who have always complained the rules made it hard to operate in Britain, prompting them to move much of their business to Luxembourg.

On top of that, London and Beijing will trade the yuan against the dollar directly, avoiding the dollar.

“The Chinese currency, the renminbi, is not terribly well known in Britain at the moment. But over my lifetime I think it’s going to become almost as familiar as the dollar, and I want British businesses involved in trading it, investing in it,” Osborne told BBC television in China.

Currently London accounts for 62 percent of yuan trades outside China and Hong Kong, according to data from financial services provider SWIFT. The latest move will give the renminbi a firmer footprint in Europe and strengthen London’s platform to develop the offshore RM (renminbi) bond market.

According to an HSBC forecast, within 5 years a third of China’s total trade will be in yuan, which will make it fully convertible and elevate it into the top 3 exchange currencies. According to data compiled by Bloomberg, the yuan has already strengthened 36 percent against the dollar and 47 percent versus the pound since 2005.

source »

We have just released the Second Edition of Towards Healthcare Emancipation eBook. The proceeds from this book will be used to fund our next project, Towards Energy Emancipation.

The aim is to make the subject of free energy more understandable for the layman so that anybody could replicate and install his own power plant and be completely living off-grid.

If you haven’t done so, please like our FB page to encourage others to learn more about our work.

Thank you very much for your valuable support.

US Default: Dress Rehearsal for Gov’t Privatization

We thought that the privatization of the United States had been completed. It seems they want this privatization more “public”, for the intellectual consumption of the Sheeples.

The ‘shutdown’ of the US government and the financial climax associated with a deadline date, leading to a possible ‘debt default’ by the federal government, is a money-making undertaking for Wall Street.

Several overlapping political and economic agendas are unfolding. Is the shutdown – implying the furloughing of tens of thousands of public employees – a dress rehearsal for the eventual privatization of important components of the federal state system?

A staged default, bankruptcy and privatization is occurring in Detroit (with the active support of the Obama administration), whereby large corporations become the owners of municipal assets and infrastructure.

The important question: could a process of ‘state bankruptcy’, which is currently afflicting local level governments across the land, realistically occur in the case of the central government of the United States of America?

This is not a hypothetical question. A large number of developing countries under the brunt of IMF ‘economic medicine’ were ordered by their external creditors to dismantle the state apparatus, fire millions of public sector workers as well as privatize state assets. The IMF’s Structural Adjustment Program (SAP) has also been applied in several European countries.

Will this gamut of deadly macro-economic reforms engineered by Wall Street and the Federal Reserve be conducive to widespread civil disorder across the United States?

While the declaration of a national emergency or martial law is not envisaged, reports confirm that the Department of Homeland Security (DHS) is currently “engaged in acquiring heavily armored tanks, which have been seen roaming the streets.” In the words of Ellen Brown, “somebody in government is expecting some serious civil unrest…”

Fiscal Collapse

Flashback to the meltdown of Wall Street in September 2008. In the wake of the economic crisis, a process of fiscal collapse was initiated.

The evolving fiscal crisis had set the stage. It has a direct bearing on the issue of shutdown of the federal government and debt default.

The Bush and Obama bank bailouts led to the appropriation of $1.45 trillion of US tax revenues. This money was channeled to Wall Street under Bush’s Troubled Assets Relief Program (TARP) and Obama’s bailout program initiated at the outset of his first term. This money was transferred to the banks.

Meanwhile, ‘defense expenditure’ in support of a war economy had spiraled: $740 billion had been allocated (FY 2010) to fund a vast process of militarization including America`s wars in the Middle East and Central Asia.

‘Black budgets’

Of significance, there were several other unreported shadowy multibillion dollar bailouts which do not appear in government accounts, not to mention the Pentagon’s black budgets which are not included in the official expenditure accounts of the Department of Defense.

According to Aviation Week in a 2009 report, “the Pentagon’s ‘black’ operations, including the intelligence budgets nested inside it, are roughly equal in magnitude to the entire defense budgets of the UK, France or Japan, and 10 per cent of the total.”

‘War and Wall Street’: Spiraling public debt

In the wake of the 2008 financial crisis, a new structure of public indebtedness had been created. Without accounting for the ‘black budgets’ and ‘shadowy bank bailouts’, reported defense expenditures plus the bank bailouts amounted to a staggering $2.35 trillion. Total revenue in FY 2010 was of the order of $2.38 trillion.

In other words, these two categories of expenditure, namely War and Wall Street “had eaten up” (together with interest payments on the public debt) the totality of federal government revenues.

The $2.35 trillion included the handouts to the banks plus military expenditure and the funding of the multibillion dollar DoD contracts with Lockheed Martin, Raytheon, Northrop Grumman, British Aerospace, et al.

No money left from public purse to fund regular govt programs

What this warped budgetary structure implied (in FY 2009 and 2010) was that there was no money (i.e. residual funds) ‘left over’ from the public purse (tax revenues and other sources of federal government revenue) to fund regular government programs.

All other categories of expenditure including Medicare, Medicaid, social security as well as public investments in infrastructure, etc. had to be financed through debt creation (emission of Treasury bills and government bonds), namely through a dramatic increase in the public debt from $9.9 trillion in FY 2008 to 16.7 trillion (October 2013), a staggering increase of almost 70 percent.

In essence, the federal government has been financing its own indebtedness through generous handouts to Wall Street and the military industrial complex.

Widening budget deficit

These developments are also characterized by a widening budget deficit in the wake of the 2008 financial crash. (See CBO graphs below, which indicate the figures for the budget deficit as well as the forecast for 2012-2022).

The Congress Budget Office (CBO) contends that the ‘estimates’ for 2013-2022 are based on revised historical values of Gross Domestic Product by the Bureau of Economic Analysis (BEA). This is a nonsensical statement.

Yet the Congress Budget Office (CBO) also acknowledges that “the federal budget deficits [2013-2022] are now expected to shrink dramatically.” These are not our words, but those of the CBO. And these ‘forecasts’ have nothing to do with revised historical values of GDP. They have to do with austerity measures and macro-economic policy.

Budgetary shift: ‘Economic shock therapy’

In a matter of three years, according to the CBO forecast, the budget deficit will be reduced from 7 percent of GDP in 2012 to 2 percent in 2015.

A budgetary shift of this nature can only be implemented by ‘economic shock therapy’ leading to socially devastating cuts in public expenditure, which will inevitably result in a wave of civil unrest.

Built into these forecasts is the presumption that drastic austerity measures leading to major cuts in government spending will be carried out over a ten year period (2013-2022) thereby reducing the size of the budget deficit as well as its percentage ratio to GDP. We are not dealing with statistical concepts, the CBO forecasts through these 2013-20122 figures a process of fiscal disintegration and impoverishment of the American people.

Entitlement programs: Medicare, Medicaid, social security

The so-called CBO ‘estimates’ for 2013-2022 are based on the assumption that austerity measures (which have not yet been formally adopted) will lead to the downsizing, phasing out and/or privatization of a large number of state programs, including Medicare, Medicaid and social security. How else would it be possible to slash the budget deficit from 7 to 2 percent of GDP in three fiscal years?

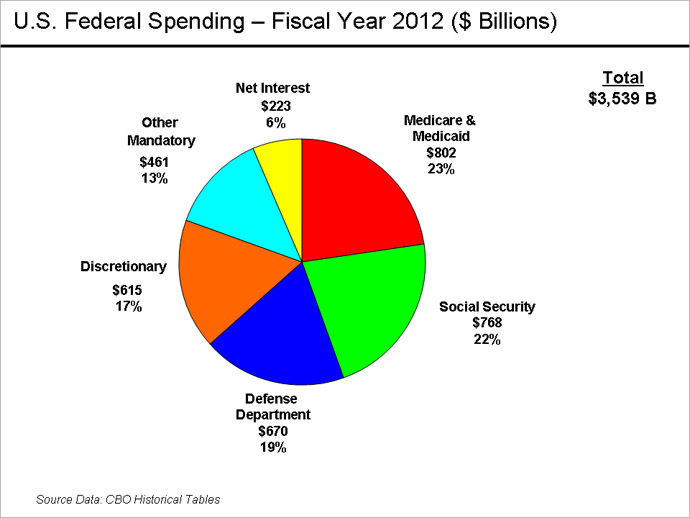

Medicare, Medicaid and Social Security represented in FY 2012, 45 percent of total government expenditure (see CBO Chart on Federal Government Spending for FY 2012, below).

Meanwhile, legislation has been launched in the House of Representatives to curtail the Food Stamp program drastically over a 10-year period (FY 2013-2022). “The US House of Representatives has passed a bill that would slash food stamp funding by nearly $40 billion over 10 years, kicking 4 million people off the program next year. The food stamp bill would cut $39 billion from the Supplemental Nutrition Assistance Program (SNAP) over 10 years. It would force adults between 18 and 50 to either work or attend work training to reapply for benefits, and would also institute drug testing for recipients.”

It is highly unlikely that the budget of the Department of Defense (19 percent) will be used to reduce the budget deficit.

Quantitative Easing: ‘Keeping the ship afloat’

In a bitter irony, while the Wall Street financial institutions were the recipients of the bailouts, they are also the creditors of the federal government, which had been precipitated into a structure of deficit financing controlled by Wall Street. This deficit financing – which was facilitated by Quantitative Easing – is distinct from the Keynesian framework. It is controlled by the creditors. It does not create employment, it is not expansionary. It has little bearing on the real economy.

This post-2008 fiscal structure has had a fundamental impact on the process of debt formation. Tax and other federal government revenues had been assigned in 2008-2009 to bailing out the banks while relentlessly funding the war economy, including the financing through black budgets of a growing number of private military and security companies (PMSC).

The public debt has increased by almost 70 percent in five years, from 9.9 trillion in 2008 to 16.7 trillion in 2013 (October 2013 estimate of the debt ceiling, see graphs above).

The various phases of Quantitative Easing (QE) throughout the Obama presidency were largely intended by Wall Street to keep the ship afloat, with an increasingly larger share of the debt owned by the Federal Reserve (in the form of Treasury bills). The Fed has largely been involved in propping up its assets.

Under QE, tens of billions of dollars are injected into financial markets. Quantitative easing has not resulted in a positive stimulus of the real economy. “The real goal of the Federal Reserve is to guarantee the continual profitability of Wall Street and the personal incomes of the super-rich.”

The Fed is not a publicly-owned central bank; it is a network of 12 private US banks, with the New York Federal Reserve Bank playing a key role. Operating under a semi-secret veil, major Wall Street financial institutions (including the big four) are the ‘stakeholders’ of the Federal Reserve, which ultimately call the shots on Capitol Hill. At the outset of the Obama administration in 2009, the Federal Reserve Banking system (which is an unaccountable private entity) has been granted increased authority in its management of the US economy, overshadowing the prevailing system of public regulation of the financial system, as well as reinforcing the subordinate role of the US Treasury in relation to Wall Street.

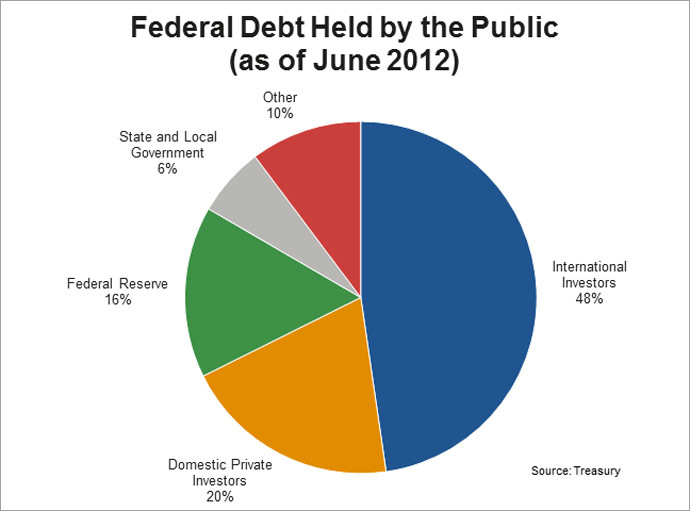

Policies pertaining to the shutdown of the government and the statutory debt ceiling are determined by Wall Street and the Federal Reserve, the US government’s largest creditor. The Federal Reserve Banks currently hold $2.1 trillion of US public debt. Japan and China respectively own $1.1 trillion and $1.3 trillion of the US public debt. Based on Jun 2012 figures, the Federal Reserve owns 16 percent of the federal debt held by the public.

The New York Federal Reserve Bank (the largest of the Federal Reserve banks) holds a significant portion of the total holdings of the Federal Reserve system, composed of 12 constituent banks. (source: www.nationalpriorities.org)

Were the Federal Reserve to be a publicly-owned central bank, quantitative easing would have an entirely different dynamic: the government rather than the Fed (acting on behalf of Wall Street) would be calling the shots. Under a publicly-owned central banking arrangement, $2 trillion worth of public debt could be canceled, thereby creating conditions for the funding of social programs.

The result of these macroeconomic reforms has been mass unemployment. The American people – including the middle class – have been impoverished by the Wall Street establishment, which ultimately decides on debt default and the statutory ceiling placed on the public debt.

Under pressure from Wall Street and the Federal Reserve, the choices of the US government are limited to the following options: “State programs can either be downsized, phased out or transferred out of the public purse to the private corporate sector, implying in all cases the layoff of tens of thousands of public employees.”

No major reforms of the structure of indebtedness are contemplated by the US Congress, which could meaningfully change the government’s relationship to the Federal Reserve and its Wall Street handlers. The creditors ultimately decide.

What are contemplated are marginal modifications of the status quo including legislation to push the debt limit to December 31st 2014.

This token arrangement would temporarily increase the federal government’s borrowing ability through the issuing of Treasury bills and government bonds by about $1 trillion. Under this scheme, however, the powers of the Wall Street Banks and the New York Federal Reserve would not only be maintained they would be reinforced.

The ultimate objective is to develop a full-fledged proxy State under the helm of the financial establishment. Both the Executive as well as the US Congress are to remain under the control of Wall Street.

Privatization of the American state?

The inevitable scenario established in the wake of the 2008 crisis is fiscal collapse, leading to “the possible phasing out and/or curtailment of social programs, the privatization of large sectors of public sector activity.”

The fiscal ceiling having now been reached, possibly with a deadline, the government is being pressured by its Wall Street handlers – who control decision-making in the US Congress – to curtail and downsize social programs, as well as initiate the transfer of public assets and institutions into the hands of private corporations. There is also a movement to cut as well as privatize social security and Medicare.

The privatization of public monuments, museums, national parks, the post office etc. has been raised in recent media reports as a possible ‘solution’ to the debt crisis. But let us not be misled: the process of acquisition of federal public property including infrastructure and state institutions is likely to go much further.

The public sector is up for grabs. Wall Street will eventually go on a buying spree picking up state-owned assets at rock bottom prices.

Ironically, the money transferred by the US government to Wall Street under the bailouts in 2008-2009 can now be used by Wall Street to buy out state property and assets. What this means is that the federal government not only finances its own indebtedness, it is also financing the privatization program (at taxpayers’ expense), leading to the demise of federal government programs.

This process of privatization of the state is nothing new, it has been applied in developing countries under the helm of the IMF, whereby state corporations are auctioned off and transferred into the hands of foreign corporations. It has also been applied in Eastern Europe, as well more recently in several countries of the European Union

The proceeds of the privatization program are channeled to the state treasury to meet outstanding debt obligations. In Brazil in the 1990s, important state assets in mining and forestry were purchased by Citi Group, which was Brazil’s largest foreign creditor bank. Ironically, the proceeds of the privatization of the assets purchased by Citi Group were channeled back to Citi Group in the form of debt servicing.

Existing state programs are transferred to private corporations either through outright sale of state assets or through outsourcing of government services to the private sector.

Large numbers of government employees would be laid off as a result of restructuring and privatization. Government services would be sold to the public at a much higher price.

Privatization of American cities

The takeover of State assets in America is well under way largely at the municipal and state level. We recall Orange County, California, which went bankrupt in 1994, Jefferson County, Alabama, which filed for Chapter 9 bankruptcy in 2011, and more recently Detroit, Michigan, in 2013. In these and other county/municipal bankruptcies, public assets, lands and infrastructure are sold off to private investors. Across the US, more than 100 municipalities are facing bankruptcy.

The bankruptcies of local level governments immediately backlash on pension funds. The privatization of federal State assets on a significant scale, as well as the takeover and privatization of public services is the next stage of this socially devastating economic restructuring process.

Speculative onslaught

There is another related agenda, which will be the object of a forthcoming article.

The uncertainty underlying the government shutdown and debt default is the object of a wave of speculative activity on major markets.

Wall Street financial institutions not only exert a decisive influence in the formulation of the administration’s fiscal and monetary agenda, they also control the movement of currency markets, commodity and stock markets through large scale operations in derivative trade.

Most of the key actors in the US Congress and the Senate involved in the shutdown debate are controlled by powerful corporate lobby groups including, of course, Wall Street. The latter are those which ultimately decide on the outcome. They are not only in a position to influence the results of the congressional process, they also have foreknowledge of the nature and timing of key decisions and they are in a position to reap multibillion dollar speculative gains in the derivative markets by speculating on policy outcomes of which they have advanced knowledge.

Those who determine the government’s debt policy, namely the Wall Street creditors, also have ‘inside information’ or prior knowledge of the chronology and outcome of the government shutdown impasse. They will make billions of dollars in windfall profits

While Wall Street is instrumental in triggering the debt ceiling impasse, major financial institutions will also be placing their bets in large scale speculative transactions.

The statements, views and opinions expressed in this column are solely those of the author and do not necessarily represent those of RT.

–

We have just released the Second Edition of Towards Healthcare Emancipation eBook. The proceeds from this book will be used to fund our next project, Towards Energy Emancipation.

The aim is to make the subject of free energy more understandable for the layman so that anybody could replicate and install his own power plant and be completely living off-grid.

If you haven’t done so, please like our FB page to encourage others to learn more about our work.

Thank you very much for your valuable support.

China Moves for A New Global Currency

Just a few days ago, we read that China is setting the stage for a new world reserve currency. Although we are expecting this to happen, it is still a shocking reality for the West.

ARVE Error: need id and providerThrough its official mouthpiece, China unleashed some very strong words against US foreign policies.

In reading the article below, let us put in context all the other recent articles especially Karen Hudes’ dropping of the “J” word.

BEIJING, Oct. 13 (Xinhua) — As U.S. politicians of both political parties are still shuffling back and forth between the White House and the Capitol Hill without striking a viable deal to bring normality to the body politic they brag about, it is perhaps a good time for the befuddled world to start considering building a de-Americanized world.

Emerging from the bloodshed of the Second World War as the world’s most powerful nation, the United States has since then been trying to build a global empire by imposing a postwar world order, fueling recovery in Europe, and encouraging regime-change in nations that it deems hardly Washington-friendly.

With its seemingly unrivaled economic and military might, the United States has declared that it has vital national interests to protect in nearly every corner of the globe, and been habituated to meddling in the business of other countries and regions far away from its shores.

Meanwhile, the U.S. government has gone to all lengths to appear before the world as the one that claims the moral high ground, yet covertly doing things that are as audacious as torturing prisoners of war, slaying civilians in drone attacks, and spying on world leaders.

Under what is known as the Pax-Americana, we fail to see a world where the United States is helping to defuse violence and conflicts, reduce poor and displaced population, and bring about real, lasting peace.

Moreover, instead of honoring its duties as a responsible leading power, a self-serving Washington has abused its superpower status and introduced even more chaos into the world by shifting financial risks overseas, instigating regional tensions amid territorial disputes, and fighting unwarranted wars under the cover of outright lies.

As a result, the world is still crawling its way out of an economic disaster thanks to the voracious Wall Street elites, while bombings and killings have become virtually daily routines in Iraq years after Washington claimed it has liberated its people from tyrannical rule.

Most recently, the cyclical stagnation in Washington for a viable bipartisan solution over a federal budget and an approval for raising debt ceiling has again left many nations’ tremendous dollar assets in jeopardy and the international community highly agonized.

Such alarming days when the destinies of others are in the hands of a hypocritical nation have to be terminated, and a new world order should be put in place, according to which all nations, big or small, poor or rich, can have their key interests respected and protected on an equal footing.

To that end, several corner stones should be laid to underpin a de-Americanized world.

For starters, all nations need to hew to the basic principles of the international law, including respect for sovereignty, and keeping hands off domestic affairs of others.

Furthermore, the authority of the United Nations in handling global hotspot issues has to be recognized. That means no one has the right to wage any form of military action against others without a UN mandate.

Apart from that, the world’s financial system also has to embrace some substantial reforms.

The developing and emerging market economies need to have more say in major international financial institutions including the World Bank and the International Monetary Fund, so that they could better reflect the transformations of the global economic and political landscape.

What may also be included as a key part of an effective reform is the introduction of a new international reserve currency that is to be created to replace the dominant U.S. dollar, so that the international community could permanently stay away from the spillover of the intensifying domestic political turmoil in the United States.

Of course, the purpose of promoting these changes is not to completely toss the United States aside, which is also impossible. Rather, it is to encourage Washington to play a much more constructive role in addressing global affairs.

And among all options, it is suggested that the beltway politicians first begin with ending the pernicious impasse.

source »

We have just released the Second Edition of Towards Healthcare Emancipation eBook. The proceeds from this book will be used to fund our next project, Towards Energy Emancipation.

The aim is to make the subject of free energy more understandable for the layman so that anybody could replicate and install his own power plant and be completely living off-grid.

If you haven’t done so, please like our FB page to encourage others to learn more about our work.

Thank you very much for your valuable support.

–

Losing faith: Global financiers look to de-Americanize

A US debt default could hit on Thursday, and world leaders are second guessing the dominant role America plays in finance. Regardless of the final decision in Washington, confidence and credibility in the US has already eroded.

In an editorial published by the Chinese state-owned press agency Xinhua, a columnist says the US economy has ‘failed’ and put many countries who hold state assets in dollars at risk.

“To that end, several corner stones should be laid to underpin a de-Americanized world,” the editorial read.

Last week China, the biggest US creditor, started to make preparations for a technical default on loans. The European Central Bank and the People’s Bank of China (PBC) have agreed to start supplying each other with their currencies, avoiding the dollar as an intermediary currency. The currency swap agreement will last for three years and provide a maximum of 350 billion yuan ($56 billion) to the ECB and 45 billion euro ($60.8 billion) to the PBC.

In a further sign of growing distrust, China introduced a so-called “haircut”, or a discount, on the value of US Treasuries held as collateral against futures trades.

Developing and developed nations are equally concerned, and institutions like the World Bank and the International Monetary Fund (IMF) have issued several warnings.

Christine LaGarde, managing director of the IMF told the US they must uphold their financial promises to the international community and raise their debt ceiling. Failing to do so would put the world “at risk of tipping yet again into a recession,” LaGarde said in an interview on NBC’s ‘Meet the Press’, which aired on October 13.

“You have to honor your signature, … give certainty to the rest of the world,” LaGarde urged the US, a strong supporter of the international lending tool.

The country that has long provided a sturdy backbone to the global economy is now teetering on a mass default. If US lawmakers don’t forge a solution to raising the debt ceiling by October 17, investors with US treasury bonds, one of the lowest-risk assets, could suffer.

“It’s not just China that’s at the mercy of US lawmakers, its everybody in the world that is at the mercy of US lawmakers right now,” David Kuo, Investment Advisor at Motley Fool, told RT .

“China is trying to diversify away from US Treasuries,” said Kuo, adding investors “cannot just assume an asset is 100 percent safe.”

China holds nearly $1.3 trillion in Treasuries, Japan has $1.14 trillion, and other big foreign creditors include Caribbean creditors, Brazil, Taiwan, Russia, and European nations.

Other creditors have decided to keep calm.

Russia, ranked the 11th on the list of the US top creditors with the estimated $132 billion in US Treasuries, plans to keep their Treasuries.

“I don’t see the need for revising our reserve investment strategy in US Treasuries,” Russian Finance Minister Anton Siluanov said at a press conference on October 11 following a meeting of the G20 finance and Central Bank chiefs.

“What’s happening now, I hope, is a fairly short-term situation,” Siluanov told reporters, noting Russia’s investment plan is long-term.

If the US misses the debt ceiling deadline of October 17 and stops paying its creditors, it would be the first major Western government to do so since Nazi Germany under Hitler in 1933, which wasn’t able to pay its debts following World War I.

The US has a bank holiday today in honor of Columbus Day; however, after making little headway on solving the budget gap, both the Senate and the House will hold sessions on Monday.

For Republicans, Obamacare has been a major stumbling block in agreeing to raise the debt ceiling, as they see the legislation as antithetical to their ‘small government’ philosophy.

source »