At next week’s BRICS summit Moscow plans to unveil new payments platform for international trade without need for dollar, Reuters reports.

Continue reading BRICS to Discuss New Global Financial SystemCategory Archives: Banking & Finance

The Global Gambit: Unraveling the Complexities of Russian Asset Confiscation

In a bold move that has sent ripples through the global financial community, the United States House of Representatives has passed legislation that could pave the way for the confiscation of billions of dollars in frozen Russian assets.

Continue reading The Global Gambit: Unraveling the Complexities of Russian Asset ConfiscationGlobal Market Crash 2024: Causes, Consequences, and the Fed’s Role

The global financial markets experienced a significant shock on August 5, 2024, as fears of a potential US recession triggered a widespread sell-off across various asset classes. This article explores the causes and consequences of this market crash, its impact on different sectors, and the role of the Federal Reserve in stabilizing the situation.

Continue reading Global Market Crash 2024: Causes, Consequences, and the Fed’s RoleThe Great Divide: Unveiling the Gap Between Paper and Physical Economies

In the intricate web of global finance, a puzzling phenomenon has captured the attention of economists, policymakers, and financial experts alike: the growing chasm between the size of the economy as represented on paper and the tangible, physical economy that exists in the real world.

Continue reading The Great Divide: Unveiling the Gap Between Paper and Physical EconomiesBRICS Launching an Independent Financial System

Countries of the BRICS economic bloc are currently working on the launch of a financial system that would be independent of the dominance of third parties, according to the Russian Ambassador to China Igor Morgulov.

Continue reading BRICS Launching an Independent Financial SystemThe Death of the Petrodollar: What Really Happened Between the US and Saudis?

News about the expiration of a Washington-Riyadh deal may be fake, but an arrangement that is key to the dollar’s success has eroded.

Continue reading The Death of the Petrodollar: What Really Happened Between the US and Saudis?A Great Wealth Transfer is Underway: How the West Lost Control of the Gold Market

Pricing power in a market long dominated by Western institutional money is moving East and the implications are profound.

Continue reading A Great Wealth Transfer is Underway: How the West Lost Control of the Gold MarketBRICS’ New Step to End US Dollar Dominance

The BRICS bloc of emerging economies is considering developing an independent payment system based on digital currencies and blockchain to reduce reliance on western financial systems.

Continue reading BRICS’ New Step to End US Dollar DominanceThe End of the USD Reserve Currency Era – Experts Predict a Paradigm Shift

The imposition of sanctions served as a wake-up call to the global community regarding the vulnerabilities associated with the dollar’s usage.

Continue reading The End of the USD Reserve Currency Era – Experts Predict a Paradigm ShiftA Multi-faceted Deception: The COVID-19 Power Grab as “Organized Crime”

Many holes are busting through the thick mental wall of media-generated obstructions meant to block wide public understanding of the COVID-19 power grab. The fake fight to vanquish the celebrity coronavirus is being widely exposed as a multi-faceted deception.

Continue reading A Multi-faceted Deception: The COVID-19 Power Grab as “Organized Crime”Russia Confirms BRICS Will Create A Gold-Backed Currency

The news regarding the BRICS (Brazil, Russia, India, China, and South Africa) implementing their plan to create a new international currency has gained momentum. The currency will be backed by gold, as announced on July 7, 2023.

In a recent meeting in Cape Town, South Africa, the foreign ministers of the BRICS countries, along with representatives from more than twelve nations, emphasized their intention to establish an international trading currency.

This undertaking, involving countries representing around 40 percent of the global population and a combined economic output comparable to that of the United States, has the potential for significant consequences.

Additionally, several other countries, such as Saudi Arabia, United Arab Emirates, Egypt, Iran, Algeria, Argentina, and Kazakhstan, have expressed interest in joining the BRICS alliance.

The main objective of the BRICS countries is to decrease their economic and political reliance on the US dollar, challenging the influence of the US dollar on the global stage. They aim to introduce a new international currency for commercial and financial transactions, replacing the US dollar as the standard means of transaction.

The motivation behind this initiative is clear. The US administration has frequently used the US dollar as a “geopolitical weapon” and engaged in what some refer to as “financial warfare.” Through sanctions and cutting off access to the US dollar capital market and international payment systems, the US has exerted control over enemy nations.

These actions have raised concerns in many non-Western countries, highlighting the political risks associated with holding US dollars. As a result, these countries have started restructuring their foreign reserves by reducing US dollar holdings, diversifying into other currencies, and increasing their gold reserves.

According to the search results, the latest data on gold holdings of BRICS member countries is as follows:

- The BRICS countries have a combined gold reserves of 5,452.7 tons as of the first quarter of 2023, with a market value of around 350 billion US dollars.

- China has quadrupled its gold reserves over the past twenty years, and Russia announced in March 2022 that they were linking the ruble to gold at five thousand rubles per gram and requiring payment for their exports in rubles.

- Several sources suggest that the BRICS countries are exploring the possibility of a gold-backed currency, with a more specific framework potentially being announced during the BRICS summit in South Africa.

- In addition, there have been reports of the BRICS countries mulling the formation of a single gold trade system.

- While the BRICS countries are the second largest owner of gold reserves after the US, it’s unclear whether they have increased their gold holdings in recent years or if there have been any significant changes in their gold reserves.

While specific details about the structure of the new BRICS currency are not yet available, it is worth speculating on potential scenarios. One possibility is the establishment of a new bank, the “BRICS Bank,” funded by gold deposits from central banks within the BRICS alliance. The physical gold holdings would be recorded as assets on the balance sheet of the BRICS Bank and could be denominated as “BRICS gold,” with each unit representing one gram of physical gold.

The BRICS Bank could then provide loans denominated in BRICS gold to exporters and importers. These loans would be funded through credit contracts with holders of BRICS gold, who would transfer their deposits to the BRICS Bank for a designated period in exchange for interest. The BRICS Bank could also accept additional gold deposits from international investors, allowing them to hold interest-bearing BRICS gold deposits.

BRICS gold could potentially serve as international money, an internationally recognized unit of account in global trade and financial transactions. This new de facto gold currency could exist solely as an accounting unit and be redeemable on demand, without the need for physical minting.

However, the successful transition to using BRICS gold as an international trade and transaction currency would likely have significant consequences:

- The demand for gold would likely increase sharply, impacting gold prices not only in US dollars and euros but also in the currencies of the BRICS countries.

- The surge in gold prices would devalue the purchasing power of official currencies, including the US dollar and the BRICS currencies. Prices of goods denominated in these currencies would likely skyrocket, leading to a depreciation of all existing fiat currencies.

- The BRICS countries would accumulate gold reserves, particularly if they maintain trade surpluses. They would be the primary beneficiaries of this currency shift, while countries with trade deficits, particularly the US, would face losses.

The aforementioned points demonstrate the potential disruptive nature of the proposal to create a new international trading currency backed by gold.

The actions taken by the BRICS countries could have a profound impact on the global economic and financial framework, resembling a landslide in terms of changes.

It remains intriguing to observe the approach that the BRICS nations will adopt during their meeting in Johannesburg, South Africa, scheduled for August 22-24.

Here’s How The End Of The US Dollar’s Global Dominance Will Play Out

Much of the world now supports de-dollarization. It will happen, but not as a “big bang”.

Continue reading Here’s How The End Of The US Dollar’s Global Dominance Will Play OutCentral Banks Hoarding Gold After Russian Asset Freeze

Following the Western sanctions that froze Russian assets abroad because of the special military operation in Ukraine, sovereign investors now prefer to hoard physical gold over derivatives or equity indexes (ETFs).

Continue reading Central Banks Hoarding Gold After Russian Asset FreezeGlobal Planned Financial Tsunami Has Just Begun

Since the creation of the US Federal Reserve over a century ago, every major financial market collapse has been deliberately triggered for political motives by the central bank.

Continue reading Global Planned Financial Tsunami Has Just BegunPetroDollar Dumping: Saudi Arabia May Join BRICS Bank

The multinational lender keeps expanding its global reach, aiming to help member states reduce dependence on the US dollar and euro.

Continue reading PetroDollar Dumping: Saudi Arabia May Join BRICS BankThe Flight From the US Dollar

On March 20, Chinese President Xi Jinping met with Russian President Vladimir Putin in Moscow. In his article in the Russian media preceding the meeting, Xi enthused that “China-Russia trade exceeded 190 billion U.S. dollars last year, up by 116 percent from ten years ago.”

Continue reading The Flight From the US DollarThe Federal Reserve Cartel: The Solution

Thomas Jefferson opined of the Rothschild-led Eight Families central banking cartel which came to control the United States, “Single acts of tyranny may be ascribed to the accidental opinion of the day, but a series of oppressions begun at a distinguished period, unalterable through every change of ministers, too plainly prove a deliberate, systematic plan of reducing us to slavery”.

Continue reading The Federal Reserve Cartel: The SolutionThe Signs of De-Dollarization are Everywhere

De-dollarization is increasingly making headlines and you don’t have to look too hard to find examples.

Continue reading The Signs of De-Dollarization are EverywhereOver 2,000 US Banks are Insolvent

The US banking sector has recently been hit by a major crisis.

Continue reading Over 2,000 US Banks are InsolventTrading in US banks halted as financial panic spreads

More regional lenders have seen their shares plummet, prompting regulators to intervene.

Continue reading Trading in US banks halted as financial panic spreadsDe-Dollarization Kicks into High Gear

The US dollar is essential to US global power projection. But in 2022, the dollar share of reserve currencies slid 10 times faster than the average in the past two decades.

Continue reading De-Dollarization Kicks into High GearASEAN Finance Ministers & Central Banks Consider Dropping US Dollar, Euro, Yen, Phasing Out Visa and Mastercard

An official meeting of all ASEAN Finance Ministers and Central Bank Governors kicked off on Tuesday (March 28) in Indonesia. Top of the agenda are discussions to reduce dependence on the US Dollar, Euro, Yen, and British Pound from financial transactions and move to settlements in local currencies.

Continue reading ASEAN Finance Ministers & Central Banks Consider Dropping US Dollar, Euro, Yen, Phasing Out Visa and MastercardIndia’s New Foreign Trade Policy Aims to Smash Dollar’s Hegemony

The Chinese yuan may be the perfect foil for the rupee to usher in a new multipolar order for global trade.

Continue reading India’s New Foreign Trade Policy Aims to Smash Dollar’s HegemonyDozens of US Banks at Risk of Repeating SVB Collapse – Study

Many other lenders are also sitting on unrealized losses caused by the rapid rise in interest rates.

Nearly 200 American banks face similar risks to those that led to the implosion and bankruptcy of Silicon Valley Bank (SVB), according to a paper posted this week to the Social Science Research Network. SVB, a major US lender focused on the tech and startup sectors, was shut down by regulators last week after massive deposit outflows.

In the study, four economists from prominent US universities estimated how much market value the assets held by US banks have lost due to recent interest rate hikes.

“From March 07, 2022, to March 6, 2023, the federal funds rate rose sharply from 0.08% to 4.57%, and this increase was accompanied by quantitative tightening. As a result, long-dated assets similar to those held on bank balance sheets experienced significant value declines during the same period,” they wrote.

Although higher interest rates can benefit banks by allowing them to lend at a higher rate, many US banks have parked a significant portion of their excess cash in US Treasuries. This was done when interest rates were at near-zero levels. The value of these bonds has now greatly decreased due to the rate hikes – investors can now simply purchase newly issued bonds that offer a higher interest rate. The decline in the banks’ portfolios is unrealized, meaning the value of the securities has declined but the loss is still only ‘on paper’.

The problem arises when customers request their deposits back and banks are forced to sell their securities – at a significant loss – in order to pay depositors back. In extreme cases, this can lead to a bank becoming insolvent, or as happened with Silicon Valley Bank, the loss of confidence can trigger a bank run.

The report’s authors looked into how the amount of US lenders’ funding that comes from uninsured deposits: the greater the share, the more susceptible a bank is to a run. For instance, at SVB, where 92.5% of deposits were uninsured, the deposit outflow caused the bank to collapse in a span of only two days. The authors of the study calculated that 186 American banks do not have enough assets to pay all customers if even half of uninsured depositors decide to withdraw their money.

“Our calculations suggest these banks are certainly at a potential risk of a run, absent other government intervention or recapitalization… Overall, these calculations suggest that recent declines in bank asset values very significantly increased the fragility of the US banking system to uninsured depositor runs,” the economists concluded, noting that the number of banks at risk could be “significantly” larger if “uninsured deposit withdrawals cause even small fire sales.”

SVB’s failure sent ripples across the entire US banking industry and caused the closure of another lender, Signature Bank. Many other financial institutions have seen their stocks plunge, with the six largest Wall Street banks losing around $165 billion in market capitalization, or some 13% of their combined value. Earlier this week, the ratings agency Moody’s downgraded its outlook for the US banking system from ‘stable’ to ‘negative’, citing the “rapidly deteriorating operating environment.”

How The US Banking Crisis Could Lead to The Collapse of The Western Financial System

The growing number of institutional failures is a signal that the entire economic system is under pressure.

Continue reading How The US Banking Crisis Could Lead to The Collapse of The Western Financial SystemBillionaire Warns of Dire Aftermath of SVB Collapse

Bill Ackman says the government made “a-soon-to-be-irreversible mistake” in its treatment of the failed bank.

Continue reading Billionaire Warns of Dire Aftermath of SVB CollapseCBDCs – The Good, The Bad, & The Downright Ugly

There has been much comment over the likelihood that central bank digital currencies will be introduced. I conclude they are unnecessary — a red herring. But it does allow us to discuss their possible relevance to a new Asian super-currency.

Continue reading CBDCs – The Good, The Bad, & The Downright UglyRussia’s Sergey Glazyev Introduces the New Global Financial System

The world’s new monetary system, underpinned by a digital currency, will be backed by a basket of new foreign currencies and natural resources. And it will liberate the Global South from both western debt and IMF-induced austerity.

Continue reading Russia’s Sergey Glazyev Introduces the New Global Financial SystemDe-Dollarization Accelerates in Southeast Asia

The US is facing major moves by the global community to de-dollarize their economies. The reserve status of the US dollar will eventually come to an end, maybe not anytime soon, but sometime in the future as it is facing numerous challenges not only from major powers such as

Continue reading De-Dollarization Accelerates in Southeast AsiaThe Global South Births A New Game-Changing Payments System

Challenging the western monetary system, the Eurasia Economic Union is leading the Global South toward a new common payment system to bypass the US Dollar.

Continue reading The Global South Births A New Game-Changing Payments SystemEven The Banksters are Being Forced to Admit that the U.S. Economy is Coming Apart at the Seams

It’s wake-up time. For months, there has been a tremendous amount of denial out there. So many of the “experts” assumed that the Federal Reserve and other central banks had everything under control and that things would “return to normal” before too long. But that hasn’t happened.

Continue reading Even The Banksters are Being Forced to Admit that the U.S. Economy is Coming Apart at the SeamsThe Rise of the Global South and the Foundation of a New Currency System

Continue reading The Rise of the Global South and the Foundation of a New Currency System“The issue of creating an international reserve currency based on a basket of currencies of our countries is being worked out.”

Vladimir Putin said at the BRICS business forum.

Proof Revolving Door Between Congress and Banks Exists

The heads of America’s biggest banks welcomed a Congressional staffer into their ranks during a public hearing.

Continue reading Proof Revolving Door Between Congress and Banks ExistsUS Treasury Looking for Sanctions Wizard, Not A Joke

A new position is being created to advise the Biden administration on how to avoid collateral damage from restrictions.

Continue reading US Treasury Looking for Sanctions Wizard, Not A JokeThe Root Causes of the Current Unfolding Systemic Financial Collapse of the West

Sergey Glazyev’s thinking is rooted in an old and powerful intellectual current that derives from a strong tradition in Russia based upon state credit, national sovereignty, large-scale infrastructure, scientific progress, and win-win cooperation.

Continue reading The Root Causes of the Current Unfolding Systemic Financial Collapse of the West“Lehman Event” Looms For Europe As Energy Companies Face $1.5T In Margin Calls

European energy companies are facing margin calls of a total of $1.5 trillion in the derivatives market and many would need policy support to cover them amid wild swings and skyrocketing gas and power prices, an executive at Norway’s energy major Equinor told Bloomberg on Tuesday. According to Helge Haugane, Equinor’s senior vice president for gas and power, the $1.5-trillion estimate is even “conservative”.

Continue reading “Lehman Event” Looms For Europe As Energy Companies Face $1.5T In Margin CallsTriggering A Multi-Trillion Dollar Global Debt Crisis

“And thus it renders more and more evident the great central fact that the cause of the miserable condition of the working class is to be sought, not in these minor grievances, but in the capitalistic system itself.” Friedrich Engels, The Condition of the Working Class in England (1845) (preface to the English Edition, p.36)

Continue reading Triggering A Multi-Trillion Dollar Global Debt CrisisVatican Goes Full Technocracy With ‘Council for Inclusive Capitalism’

The idea that there is an agenda for global government among the financial and political elites of the world has long been called a “conspiracy theory” within the mainstream and the establishment media.

Continue reading Vatican Goes Full Technocracy With ‘Council for Inclusive Capitalism’The Fed Just Lobbed A Financial Nuke That Will Obliterate The Global Economy

“Take The Tragedy in Sri Lanka and Multiply By Ten”. We are living in a period of mass “Jonestown” economic delusion. Just twenty months ago – central bankers were offering to buy nearly every junk bond known to mankind, dramatically distorting the “true cost of capital.”

Continue reading The Fed Just Lobbed A Financial Nuke That Will Obliterate The Global EconomyIran-Russia Interbank Agreement Soon to Be Implemented

The pursuit of inter-banking agreements comes amid efforts by Tehran and Moscow to strengthen their economies and bypass western sanctions.

Continue reading Iran-Russia Interbank Agreement Soon to Be ImplementedThis Financial Coup d’ Etat aka Great Reset is A Planetary Takedown by Financial “Insiders”

Catherine Austin Fitts (CAF), Publisher of The Solari Report and former Assistant Secretary of Housing (Bush 41 Admin.), contends this is what the so-called “reset” looks like. High food and fuel prices along with crushing interest rates are no accident. CAF explains,

Continue reading This Financial Coup d’ Etat aka Great Reset is A Planetary Takedown by Financial “Insiders”Beyond the Dollar Creditocracy: A Geopolitical Economy

Understanding of the dollar’s world role is dominated by the ideas of ‘dollar hegemony’ and ‘US hegemony’. In this paper, based on their extensive past work, Radhika Desai and Michael Hudson reveal how these ideas are ideologies, not theories.

They reveal an understanding that is theoretically sound and accords with the historical record, a geopolitical economy of the international monetary system of modern capitalism.

They begin with a theoretical outline of how money operates under capitalism. They then consider how capitalism needs world money and, at the same time, makes its stable functioning difficult.

They then go on to trace the fundamental instability of the modern international monetary systems based on national currencies of dominant countries, from the gold standard to the current volatile and predatory dollar-centred system, and their close connection to short-term and speculative.

“Weak growth in the global economy, low and negative interest rates, the risk of endless stagnation and rising inflation, and prospects for a prolonged recession are, unfortunately, part of the economic reality. Clearly, the globalisation-based financial supercapitalism model, of which the United States was a beneficiary for quite a long time, and which relied on endless lending and financialisation, which turned the commodity markets into financial ones, has run its course.”

– Alexander Losev from the Preface

Download: https://geopolitics.co/wp-content/uploads/2022/06/Valdai-Paper-116.pdf

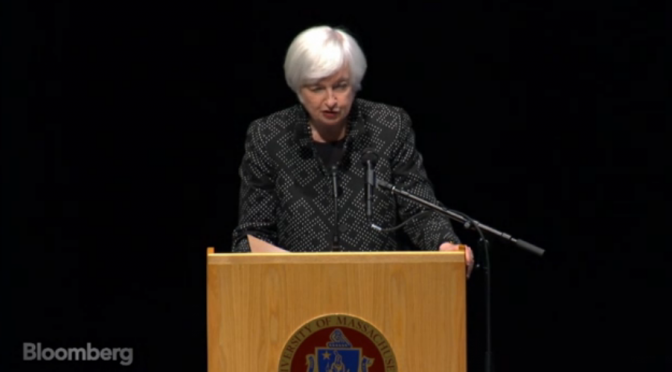

Janet Yellen Declares World Bankers’ Dictatorship

On April 13th, Treasury Secretary Janet Yellen gave a speech at the Atlantic Council in Washington. In the speech, “On the Way Forward for the Global Economy,” Yellen chillingly sketched the new “globalist order” she fantasizes will emerge from the Biden Administration’s provoked war with Russia in Ukraine—while portraying herself literally as “the world.”

Continue reading Janet Yellen Declares World Bankers’ DictatorshipDawn of a New Global Financial System

Sergey Glazyev is a man living right in the eye of our current geopolitical and geo-economic hurricane. One of the most influential economists in the world, a member of the Russian Academy of Sciences and a former adviser to the Kremlin from 2012 to 2019.

Continue reading Dawn of a New Global Financial SystemAll That Glitters is Not Necessarily Russian Gold

The “rules-based international order” – as in “our way or the highway” – is unraveling much faster than anyone could have predicted.

Continue reading All That Glitters is Not Necessarily Russian GoldRuble Rising in the Face of Sanctions

The Russian ruble has been stabilizing against the US dollar and euro, after a record drop amid Ukraine-related sanctions’.

Continue reading Ruble Rising in the Face of SanctionsSay Hello to Russian Gold and Chinese PetroYuan

The Russia-led Eurasian Economic Union and China just agreed to design the mechanism for an independent financial and monetary system that would bypass dollar transactions.

Continue reading Say Hello to Russian Gold and Chinese PetroYuanUN-Backed Banker Alliance Announces “Green” Plan to Transform the Global Financial System

The most powerful private financial interests in the world, under the cover of COP26, have developed a plan to transform the global financial system by fusing with institutions like the World Bank and using them to further erode national sovereignty in the developing world.

Continue reading UN-Backed Banker Alliance Announces “Green” Plan to Transform the Global Financial SystemLobotomized Economists Clash on the Deck of the Titanic

As the geniuses running the western financial bubble sometimes called an “economy” continue to double down on their obsession to pump a dead financial system with ever more trillions in stimulus spending, arguments are raging among brainwashed economists living in denial over the oncoming systemic collapse.

Continue reading Lobotomized Economists Clash on the Deck of the TitanicUS FinCen About to Control Global Financial Data

Washington is about to control the data of all financial transactions in the world. With the objective of combating financial crimes, the American government is about to pass a law that greatly expands the inspection power of financial regulatory agencies, which will have the freedom to use new technologies that allow them to supervise operations outside American territory.

Continue reading US FinCen About to Control Global Financial DataDebt: A “Financial Weapon” Used to Subordinate Developing Countries

“The total amount of third world debt has already been repaid six times over in interest.”(1)

Continue reading Debt: A “Financial Weapon” Used to Subordinate Developing Countries