Only recently, Draghi announced its 1.5 Trillion Euro Fed like quantitative easing, bond buying spree, and yet it falls below the bankers’ expectations. In fact, Denmark is now hyper-enticing the bond market by offering a subsidy to those who would buy these toxic derivatives.

Continue reading Euro Free Falling; Draghi is Dragged with it

Category Archives: Financial Crisis

Greek Debt Restructuring Will Burst $100 Trillion Bond Bubble

Syriza’s rise to power in Greece spells the end of the Euro and the high probability of the $100 Trillion derivatives bubble to burst. This obviously is causing sleepless nights for the Cabal.

This is probably one of the reasons why New York City must be shut down in order to give the wolves in Wall Street plenty of time to regroup.

Continue reading Greek Debt Restructuring Will Burst $100 Trillion Bond Bubble

What You Were Never Told About Greece – Alexis Tsipras' Open Letter To Germany

Alexis Tsipras’ “open letter” to German citizens published on Jan.13 in Handelsblatt, a leading German language business newspaper

Continue reading What You Were Never Told About Greece – Alexis Tsipras' Open Letter To Germany

The Super Rich Are Preparing for The PitchForks

Persistent rumors are moving around the executive circles about the preparations being made by some of the super-rich. These preparations involve among others, buying properties in far off exotic islands of the Pacific.

Continue reading The Super Rich Are Preparing for The PitchForks

Ukraine Refuses to Pay $6.6 Billion Owed to China; Losing the War

Posted on January 21, 2015

China paid Ukraine $3B two years ago for grain still not delivered, now demands refund. Another $3.6B that’s owed to China, will probably also default.

Eric Zuesse

Russia’s RIA Novosti News Agency reported, on January 17th, that China is demanding refund of $1.5 billion in cash and of an additional $1.5 billion in Chinese goods that were paid in advance by China (in 2013), for a 2012 Chinese order of grain from Ukraine, which goods still have not been supplied to China.

Continue reading Ukraine Refuses to Pay $6.6 Billion Owed to China; Losing the War

Seven Central Banks Take Anti-Deflationary Actions in Past Week

By Pam Martens and Russ Martens: January 22, 2015

The big story this week has not been news coming out of the widely covered World Economic Forum in Davos or the much anticipated bond-buying program in Europe known as QE. The big story is the sheer number of central banks moving into panic mode in the span of a week.

Continue reading Seven Central Banks Take Anti-Deflationary Actions in Past Week

A Bunch Of Criminals

A while ago, ECB President Mario Draghi announced that the Eurozone will print more paper money to bail itself out. This would mean that the banks will continue to circulate worthless currency to keep itself afloat while the population doing the actual hard work is deceptively compensated by it.

No wonder bank CEOs are fattened with huge bonuses even at these trying times.

Continue reading A Bunch Of Criminals

Switzerland Adds to List of Countries Dumping Dollar / Euro

The global movement away from the dollar continues to gain traction when the Swiss central bank signed a pact with China to trade only in yuan or renminbi.

Still, the mainstream media refuse to cover this significant departure…

Continue reading Switzerland Adds to List of Countries Dumping Dollar / Euro

€1.1 Trillion QE for Eurozone Announced; Euro Falling

The European Central Bank President Mario Draghi has decided to flood the Eurozone with Federal Reserve type quantitative easing in the staggering amount of €1.1 Trillion!

As expected the Euro fell, and the Swiss National Bank was right when it decided to decouple the Francs away from the Euro.

Continue reading €1.1 Trillion QE for Eurozone Announced; Euro Falling

50,000 Wall Street Jobs Cut

They said that sanctions against Russia is crippling the country.

Quite the contrary, it is the banksters of the West that are bleeding…

Continue reading 50,000 Wall Street Jobs Cut

Gold is the New Cash

Gold prices have soared on the recent wave of global volatility with stock market crash in China and the Swiss national currency turmoil, exceeding $1,300-1,320/oz.

© REUTERS/ Leonhard Foeger

Russia Might Implement Gold Standard to Boost Economy: Expert

MOSCOW, January 19 (Sputnik), Kristian Rouz – One of the top-valued metal commodities and a universal monetary equivalent, gold, is heading to exceed the psychological threshold of $1,300/oz., as investors in Asia-Pacific and Europe are gravely concerned with the sudden fluctuations in the Swiss national currency’s FX rate and today’s crash in mainland China’s stock markets.

Continue reading Gold is the New Cash

Swiss National Bank De-pegging of Franc Could End Euro

Last week, the Swiss National Bank decided to abandon the cap of its own currency, and allowed it to appreciate against the Euro. This move prompted investors to move away from the Euro in favor of gold and silver.

Interestingly, this Swiss move comes just a few days from the BRICS financiers’ meeting at the sidelines of the Davos Summit 2015.

Continue reading Swiss National Bank De-pegging of Franc Could End Euro

Swiss Fiasco Started A Run On Gold

BRICS decision to abandon the US dollar in favor of their local currencies, and the establishment of its own gold exchange based in Singapore late last year have started to show effects on the financial integrity of the European economy.

Continue reading Swiss Fiasco Started A Run On Gold

Bankers Panic: Greek Election Could Herald Change in Europe

by Dean Andromidas

[[PDF version of this article]

Jan. 2—The possibility of an anti-bailout and anti-austerity government coming to power in Greece, led by coalition led by the left-wing Syriza party and the nationalist Independent Greeks, has sent terror through the European oligarchy, that their Eurozone, the Europe for the bankers, will collapse. It was in Greece, in 2010, that the imposition of brutal austerity began, in an attempt to save the hopelessly bankrupt European banking system. After Greece, came Ireland, Portugal, the fleecing of the savings of Cypriots, and bankers’ governments in Spain and Italy. The Greek elections on Jan. 25 could be the beginning of the end of this nightmare.

Continue reading Bankers Panic: Greek Election Could Herald Change in Europe

The Greek Bank Runs Have Begun

It’s still the first month of 2015, and yet the Greece Central Bank is already tapping its last resort Emergency Liquidity Assistance [ELA], the same option it used back in 2011 when Greece’s economy was imploding.

We ain’t seeing nothing yet…

Continue reading The Greek Bank Runs Have Begun

Magic Growth Numbers From U.S. Government

The financial media and Wall Street economists, by refusing to ask obvious questions, have left the American people unprepared for another drop in their living standards and ability to cope.

Continue reading Magic Growth Numbers From U.S. Government

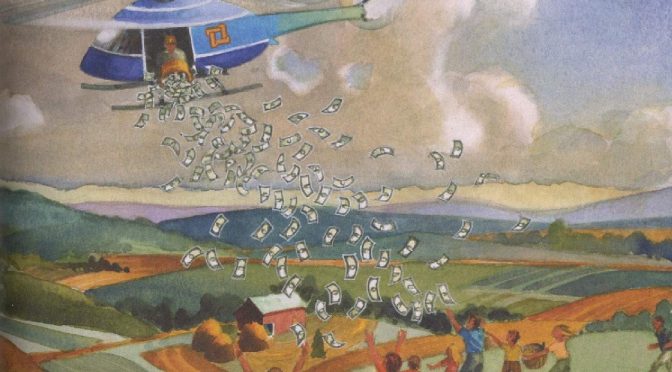

The ECB Has Lost Control; Spiegel Asks for "Helicopter Money"

The capitalist system, no matter how they justify it being the cause of the present innovations, has reached its obsolescence. In fact, planned obsolescence is deeply embedded in it, i.e. the product must fail over time so that the cycle of demand and profit must never end.

Continue reading The ECB Has Lost Control; Spiegel Asks for "Helicopter Money"

Bankruptcies on Energy Companies Have Begun

As expected, Saudi Arabia’s deliberate increases in oil production has not crippled Russia but Western energy companies only.

Continue reading Bankruptcies on Energy Companies Have Begun

Stratospheric Earnings: Goldman Sachs Tops Bonuses in 2013

US investment bank Goldman Sachs paid its senior executives the most lucrative bonuses of all UK-based banks in 2013, statistics compiled by Reuters suggest.

Continue reading Stratospheric Earnings: Goldman Sachs Tops Bonuses in 2013

First Arrest on $3.8 Trillion Forex Scandal

So far we haven’t seen any biggies being arrested yet. So called Black Swan Event is still not in sight but who knows…

We’ll wait ’til the year ends.

Happy Holidays, everyone!

Continue reading First Arrest on $3.8 Trillion Forex Scandal

U.S. Treasury Survival Kits; Financial Reset Imminent?

The Office of the Comptroller of the Currency (OCC), which conducts on-site reviews of banks throughout the country is reportedly ordering survival kits which include everything from water purification tablets to solar blankets.

We could not find any other reason for these personnel to have a need for SKs other than, at some point in the near future, they might need to work long hours inside their assigned banks, and each team might need to perform tasks that can’t be suspended until its completely finished.

Considering the huge shift we are anticipating in the financial sector, this preparation might be connected to the said global reset from fiat to asset-based currencies.

Treasury Department Seeking Survival Kits For Bank Employees

BY:

Continue reading U.S. Treasury Survival Kits; Financial Reset Imminent?

The Golden Trap of Chess Master Vladimir Putin

An article definitely to be spread and read, especially by those who have not well understood the political economic and military strategy of Putin and today’s Russia. (SFP)

Continue reading The Golden Trap of Chess Master Vladimir PutinGold Repatriation from U.S. Result in Higher Gold Prices, Weaker Dollar

Executive and research director of the world’s leading gold broker Gold Core Mark O’Byrne stated that as fears grow over huge debt levels in the US, Japan and the United Kingdom, European governments are repatriating their gold from the United States.

Continue reading Gold Repatriation from U.S. Result in Higher Gold Prices, Weaker Dollar

Banker Stabbed in Chest

Another banker bites the dust….

MassMutual Senior Vice President Found Dead, Stabbed In Chest In Apparent Homicide

Submitted by Tyler Durden on 11/24/2014 12:21 -0500

A week after stunned Tribeca woke up to news of a grizzly death in which a Citigroup managing director living on Greenwich Street was found dead in his bathtub with a slashed throat and the lack of a suicide weapon on the scene suggesting there was foul play involved, another banking executive was killed over the weekend, when 54-year-old Melissa Millian, a senior vice president at MassMutual, was found lying in a road in Simsbury, Connecticut, having been stabbed in the chest.

A week after stunned Tribeca woke up to news of a grizzly death in which a Citigroup managing director living on Greenwich Street was found dead in his bathtub with a slashed throat and the lack of a suicide weapon on the scene suggesting there was foul play involved, another banking executive was killed over the weekend, when 54-year-old Melissa Millian, a senior vice president at MassMutual, was found lying in a road in Simsbury, Connecticut, having been stabbed in the chest.

Continue reading Banker Stabbed in Chest

Netherlands Has Secretly Withdrawn 122 tons Gold from NY Fed

Everybody is moving towards gold based currencies, as “predicted”.

The Swiss are having referendum for gold based economy [here]. Last2 years or so, it was Germany that announced gold repatriation from the Federal Reserve, although, it would seem they have not changed their minds yet

Little did we know that the Dutch were secretly moving back their gold bullion from the NY Fed, too.

Continue reading Netherlands Has Secretly Withdrawn 122 tons Gold from NY Fed

End Game: Debt Cancellation & Helicopter Money

First, there was too much hype about prosperity funds, NESARA, St. Germain Trust, etc. Then it was the turn for Council on Foreign Relations [CFR] suggesting outright distribution of paper money to the masses.

Continue reading End Game: Debt Cancellation & Helicopter Money

1-Year Sentence for Crashing the Iceland Economy

Another slap on a banker’s wrist for contributing to the destruction of the entire economy…

Iceland Sentences Banker Involved In 2008 Crash to Jail

One year sentence is quickly reduced to three months as banker to decide if he will appeal

Continue reading 1-Year Sentence for Crashing the Iceland Economy

Switzerland May Give Every Citizen $2,600 a Month

Switzerland could soon be the world’s first national case study in basic income. Instead of providing a traditional social net—unemployment payments, food stamps, or housing credits—the government would pay every citizen a fixed stipend.

Continue reading Switzerland May Give Every Citizen $2,600 a Month

Financial Eyes on Switzerland Ahead of Gold Vote

Citigroup banker found dead with throat slit in swanky apartment

Large Deposits at Banks are No Longer Money

Here’s the inconvenient details about the new G20 directive for those who have big deposits in their favorite banks.

Russell Napier Declares November 16, 2014 The Day Money Dies

Submitted by Tyler Durden on 11/12/2014 23:39 -0500

Continue reading Large Deposits at Banks are No Longer Money

G20 Just Stole The Money In Your Bank Account

With the new regulation that is being agreed upon by the G20, all of your bank deposits will be considered an investment to the bank, and the bank will, in turn, consider those deposits as part of their capital.

That’s a good investment if the bank itself is stable. But that is simply not the case.

That’s why Putin took an early exit…

Continue reading G20 Just Stole The Money In Your Bank Account

Afghanistan Shocked Wall Street by Jailing 2 Bankers, Freezing Karzai Brother's Assets

Who would expect that a US military controlled territory would jail bankers including an ex-president’s brother?

Previously, Iran executed by hanging a billionaire and three others who were responsible for @2.6Billion bank scam [here], and 2 received life sentences and 25 others received 25 years in prison.

In comparison, the United States has jailed just one banker for PR’s sake.

Continue reading Afghanistan Shocked Wall Street by Jailing 2 Bankers, Freezing Karzai Brother's Assets

The $9 Billion Witness: JPMorgan Chase's Worst Nightmare

Meet the woman JPMorgan Chase paid one of the largest fines in American history to keep from talking

She tried to stay quiet, she really did. But after eight years of keeping a heavy secret, the day came when Alayne Fleischmann couldn’t take it anymore.

“It was like watching an old lady get mugged on the street,” she says. “I thought, ‘I can’t sit by any longer.'”

Continue reading The $9 Billion Witness: JPMorgan Chase's Worst Nightmare

UBS Settles Over Gold Rigging

First, there was interest rates rigging known as the Libor Scandal. Now, one bank falls and settles with court over gold price rigging.

The real price for gold is much higher than the market of the West is saying.

Continue reading UBS Settles Over Gold Rigging

How The Petrodollar Quietly Died

Submitted by Tyler Durden on 11/03/2014 23:42

Two years ago, in hushed tones at first, then ever louder, the financial world began discussing that which shall never be discussed in polite company – the end of the system that according to many has framed and facilitated the US Dollar’s reserve currency status: the Petrodollar, or the world in which oil export countries would recycle the dollars they received in exchange for their oil exports, by purchasing more USD-denominated assets, boosting the financial strength of the reserve currency, leading to even higher asset prices and even more USD-denominated purchases, and so forth, in a virtuous (especially if one held US-denominated assets and printed US currency) loop.

Continue reading How The Petrodollar Quietly Died

Dollar Decline Continues

Anchored in reality, here’s a good analysis of what is happening to the King Dollar…

The Dollar Decline Continues: China Starts Direct Convertibility With Asia’s #1 Financial Hub

Submitted by Tyler Durden on 10/30/2014 20:42 -0400

Continue reading Dollar Decline Continues

Banking Mafiosi Suicided

25 Banks Failed on ECB Stress Test

However the Western media may sugar coat it as always, the European economy is still very much in the red. They just lack the liquidity to sustain the Ponzi Scheme they have been doing for centuries.

Continue reading 25 Banks Failed on ECB Stress Test

Bank of England Payment Crashes

”think we are seeing signs of a hemorrhaging banking sector.

Just a few hours ago,

Bank of England payment system crashes

Preview of Cabalists on Trial

There are some big names from the banking industry and monarchy that are facing trial this year. Hopefully, the list should get a little longer in the days ahead.

Continue reading Preview of Cabalists on Trial

Bank Apocalypse Drill: False Flag Event or Reset?

BANK APOCALYPSE DRILL: FALSE FLAG OR RESET?

For the first time in the industry’s history, a banking “apocalypse drill” is scheduled for next week.

The “too big to fail” banks are going to “simulate” a bank collapse next week, because they do realize they are actually failing, which could mean they will simulate a confiscation of all deposits.

How else could a real banking collapse? Would the simulation include erasing all financial debts, too?

Continue reading Bank Apocalypse Drill: False Flag Event or Reset?

A Big Rat Jumps Ship Causing $42 Trillion Shockwave

The system of debt is unsustainable. It’s time to not just reboot the system, but to install a new one, preferably an Open Source type OS where everybody can participate upon.

Gross Exposes $42 Trillion Bond Market’s Key Flaw in Exit

One man shook a $42 trillion bond market last week, highlighting just how vulnerable bond prices are to shocks.

Continue reading A Big Rat Jumps Ship Causing $42 Trillion Shockwave

China Accelerates Gold Exchange Launching

While the Fed can’t contain its urge to raise interest rates, China will be strengthening its financial status further by launching its gold exchange (as opposed to stock exchange which is nothing but the endless shuffling of paper that has nothing to do with actual production) earlier than scheduled.

With the planned establishment of an alternative to SWIFT, the Cabal’s clout on world finance is diminishing by the day.

Continue reading China Accelerates Gold Exchange Launching

Dollar Collapsing

Just a few hours ago, China unleashed its so-called Stealth QE sending the dollar spiraling down sharply.

Markets React Violently To China’s Stealth QE

Controlled Collapse

Obviously, they are already expert in controlled demolition as in WTC 9/11. But can they apply the same expertise to another private entity called Federal Reserve?

Some quarters are seeing signs that indicate the Federal Reserve is undergoing a controlled collapse. Is the dollar printing machine about to shut down its operation for good?

Continue reading Controlled Collapse

US CORPORATIONS Are Dumping US$ in Favor of RMB

The Financial Reset is already unfolding right before our very noses. But it is done in a subtle manner to lessen mass disruptions.

Exactly who will benefit largely from this shift is still everyone’s guess, yet still we hope it’s the majority — the 99%.

The US Dollar had lost every reason to be the world’s reserve currency.

Continue reading US CORPORATIONS Are Dumping US$ in Favor of RMB

Seven by Christine Lagarde

Rick2012 suggested this very interesting video. Thanks Rick.

Do enjoy your weekend, everyone. Mabuhay!

Continue reading Seven by Christine Lagarde

IMF Lagarde: Most Dangerous Woman Alive?

A major Cabalist has gone overboard with expropriation of whatever is left of the poor just to fed the rich.

Expropriation Is Back – Is Christine Lagarde The Most Dangerous Woman In The World?

Submitted by Tyler Durden on 07/03/2014 19:33 -0400

Continue reading IMF Lagarde: Most Dangerous Woman Alive?

Anti-Dollar Alliance Proposed

Over in Russia, a deliberate crashing of the US dollar is proposed to end US globalist aggression. Continue reading Anti-Dollar Alliance Proposed

Worldwide Financial Criminal Network 1.0

Here’s a detailed description of who and how the Banksters stole your family’s future…

Worldwide Financial Criminal Network Revealed Part1

(MDC-NYSE) Denver Headquarters of Organized Crime. Illegal Mortgage Backed Securities $100 Trillion, Bank Bailouts, Derivatives $5,000 Trillion and the theft of 12 million American’s Homes through illegal foreclosures.

WRONG BANKERS' DEATH 3.0

Here’s the third installment to this series…